How to Consolidate Your Student Loans Without Hurting Your Credit offers a comprehensive guide to navigating the often complex world of student loan consolidation. With rising education costs, many borrowers find themselves juggling multiple loans, leading to confusion and stress. Understanding how to consolidate your loans can simplify repayment and potentially improve your financial health while protecting your credit score.

This guide will delve into the ins and outs of student loan consolidation, covering the types of loans eligible for consolidation, the impact on credit scores, and the best strategies for managing your credit during this process. By exploring your options and understanding the potential risks and rewards, you can make informed decisions that serve your financial future.

Understanding Student Loan Consolidation

Student loan consolidation is a financial strategy that allows borrowers to combine multiple student loans into a single loan. This process can simplify repayment by merging different loans into one monthly payment, often resulting in more manageable terms. While it’s essential to understand the mechanics of consolidation, knowing what types of loans can be consolidated is equally important to make informed decisions.A variety of student loans can be consolidated.

This includes federal loans, such as Direct Subsidized Loans, Direct Unsubsidized Loans, and PLUS Loans. Private student loans can also be consolidated through private lenders, although this process differs and may not yield the same benefits as federal consolidation. Understanding the types of loans eligible for consolidation is crucial for borrowers seeking the best financial options.

Benefits of Consolidating Student Loans

Consolidating student loans offers several advantages that can ease the financial burden for borrowers. Here are the key benefits of this process:

-

Simplified Payments:

By consolidating multiple loans, borrowers only need to manage one monthly payment instead of several, which reduces the likelihood of missing payments.

-

Lower Monthly Payments:

Consolidation can potentially extend the repayment term, leading to lower monthly payments. This can provide immediate relief for those struggling to meet their current payment obligations.

-

Fixed Interest Rate:

Federal loan consolidation results in a weighted average interest rate that is fixed, providing predictability in future payments.

-

Access to Benefits:

Some borrowers may regain access to certain repayment plans and forgiveness programs that they may have lost when consolidating.

-

Improved Credit Score Potential:

By consolidating and making on-time payments, borrowers can positively impact their credit scores over time.

These benefits can significantly improve a borrower’s financial situation, allowing for a more structured and attainable repayment plan. Both federal and private consolidation options should be considered carefully, as each has different implications for interest rates, repayment terms, and overall financial health.

Impact on Credit Score

Source: moneywisefamily.com

Consolidating student loans can have a significant impact on your credit score, which is a critical factor in determining your financial health. Understanding how this process affects your credit is crucial for making informed decisions. While the primary goal of loan consolidation is to simplify payments and potentially lower interest rates, it’s essential to recognize the implications for your credit history and score.When you consolidate your student loans, multiple factors can influence your credit score both positively and negatively.

These impacts depend on how you manage the consolidation process and the specific details of your existing loans. Here’s a closer look at what to consider regarding your credit score during loan consolidation.

Factors Influencing Credit Scores During Consolidation

Several elements play a role in determining how student loan consolidation affects your credit score. Here are some vital factors to consider:

- Credit Utilization: Loan consolidation can change your overall credit utilization ratio. Lowering your total outstanding debt through consolidation can positively impact your score.

- Credit Mix: A diverse credit profile can enhance your score. If consolidating adds to your variety of credit accounts, it might benefit your overall credit health.

- Age of Credit History: Consolidating may result in closing older accounts, which can decrease your average account age and negatively impact your score.

- Payment History: Consistently making timely payments after consolidation is crucial. A strong payment history positively supports your score.

- Hard Inquiries: When you apply for a new consolidation loan, a hard inquiry may occur. This could temporarily reduce your credit score, but the effect is usually minor and short-lived.

Understanding these factors can give you insight into how your credit score may be affected by the consolidation of your student loans. It’s important to weigh these aspects when considering whether to consolidate.

“Your credit score can fluctuate significantly based on how you manage your debt, particularly during major financial changes like loan consolidation.”

The impacts of consolidation can vary widely among individuals. For example, if a borrower consolidates multiple loans into one, successfully reduces their monthly payment, and maintains a history of on-time payments, they could see a rise in their credit score. Conversely, if consolidation leads to the closure of older accounts and subsequent missed payments, the credit score could take a hit.

In summary, the relationship between student loan consolidation and your credit score is nuanced, with both potential benefits and drawbacks. Being aware of these factors allows borrowers to make better-informed decisions about their financial futures.

Steps to Consolidate Student Loans

Consolidating your student loans can simplify your repayment process and potentially lower your monthly payments. By merging multiple loans into a single, more manageable loan, you can streamline your finances. However, it’s essential to understand the steps involved in the consolidation process to ensure a smooth transition.When considering consolidation, it’s important to have all the necessary documentation ready and to explore various options to find the best fit for your financial situation.

Below is a step-by-step guide to help you through the consolidation process, along with a checklist of required documents and tips for researching your options.

Step-by-Step Guide for Consolidation

The consolidation process involves several key steps that you should follow to ensure everything is handled correctly.

1. Gather Your Loan Information

Start by collecting details about all your current student loans, including loan types, interest rates, and outstanding balances. This information will help you understand your financial landscape better.

2. Research Consolidation Options

Before moving forward, take the time to explore different consolidation options available to you. Federal loan consolidation and private loan consolidation differ in terms of benefits and consequences. Compare interest rates, terms, and any potential impacts on your credit score.

3. Choose a Lender

If you opt for private consolidation, carefully select a lender that meets your needs. Look for lenders that offer favorable terms, such as low interest rates or flexible repayment plans.

4. Complete the Application

Fill out the application for consolidation with your chosen lender. Be prepared to provide necessary documentation and details about your existing loans.

5. Review the Terms

Once you receive a consolidation offer, review the terms and conditions thoroughly. Ensure you understand the new interest rate, repayment schedule, and any fees involved before accepting the offer.

6. Finalize the Consolidation

After accepting the offer, finalize the consolidation process. Your new lender will typically pay off your existing loans directly.

7. Monitor Your Credit Report

After consolidation, check your credit report to ensure that your previous loans are marked as paid off and that there are no errors.

Checklist of Required Documents for Consolidation

Before you start the consolidation process, it’s vital to have the right documents on hand. Here’s a checklist of essential documents you may need:

Identification Documents

A government-issued ID or driver’s license to verify your identity.

Loan Statements

Recent statements for each of your existing student loans to provide detailed information regarding balances and payment history.

Proof of Income

Recent pay stubs or tax returns to demonstrate your financial stability to lenders.

Social Security Number

This may be required for identification purposes when applying.

Contact Information

Ensure you have up-to-date contact information for all your existing loan servicers.

Importance of Researching Consolidation Options

Researching consolidation options is crucial in making an informed decision that aligns with your financial goals. Different lenders offer varying rates and terms, which can significantly affect your repayment strategy. Taking the time to compare options ensures that you find a plan that not only reduces your monthly payment but also fits your long-term financial strategy. Additionally, understanding the potential trade-offs—such as losing borrower benefits on federal loans—can help you avoid pitfalls.

In summary, the steps to consolidate student loans involve gathering your financial information, researching options, and ensuring you understand the terms of the consolidation. By following these steps, you can effectively streamline your student loan payments without negatively impacting your credit score.

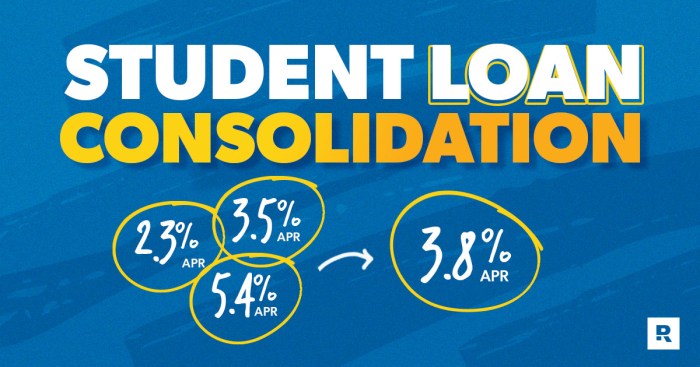

Types of Consolidation Options

Source: ramseysolutions.net

When it comes to consolidating student loans, there are primarily two paths: federal loan consolidation and private loan consolidation. Each option has unique features, benefits, and drawbacks that can significantly impact your financial future. Understanding these differences is crucial for making an informed decision that aligns with your financial goals and credit health.

Federal Loan Consolidation

Federal loan consolidation allows you to combine multiple federal student loans into a single Direct Consolidation Loan. This can simplify your repayment process by reducing the number of monthly payments you need to manage. The main advantages of federal loan consolidation include:

- Fixed Interest Rate: Your new interest rate will be the weighted average of your existing loans, rounded up to the nearest one-eighth percent, ensuring predictability in payments.

- Access to Income-Driven Repayment Plans: Consolidation may make you eligible for various income-driven repayment options, providing flexibility based on your income.

- Loan Forgiveness Options: If you work in public service, consolidating your loans can help you qualify for loan forgiveness programs after a set number of payments.

However, there are also downsides:

- Loss of Benefits: Some benefits tied to your original loans, such as interest rate discounts or principal rebates, may be lost upon consolidation.

- Longer Repayment Terms: While lower monthly payments may be appealing, they can extend the repayment period, potentially increasing the total interest paid over time.

Private Loan Consolidation

Private loan consolidation, also known as refinancing, involves taking out a new loan from a private lender to pay off your existing student loans, both federal and private. This option is particularly popular among borrowers seeking lower interest rates based on improved credit scores.The advantages of private loan consolidation include:

- Potentially Lower Interest Rates: If your credit score has improved since you first borrowed, you may qualify for lower rates, resulting in significant savings.

- Flexible Terms: Private lenders often provide more flexible repayment options, including varying terms that can fit your financial situation.

- Consolidation of Both Federal and Private Loans: This option allows you to bundle all your loans, simplifying your payments into one monthly obligation.

However, there are significant considerations:

- No Federal Protections: Unlike federal consolidation, refinancing through a private lender means you lose access to federal benefits like income-driven repayment plans and loan forgiveness.

- Credit Score Dependency: The terms you receive will heavily depend on your credit score, making it less accessible for those with lower scores.

Popular lenders for private loan consolidation include SoFi, Earnest, and CommonBond, each offering various options and competitive rates tailored to borrowers’ needs. Researching and comparing these lenders can help you find the best fit for your financial situation.

Maintaining Credit Health During Consolidation

Source: banklandmark.com

Consolidating student loans can be a savvy financial move, but it’s essential to keep an eye on your credit health throughout the process. A strong credit score not only affects your ability to secure future loans but can also influence the interest rates you receive. Here, we’ll Artikel effective strategies to ensure your credit score remains intact while you consolidate your loans.

Strategies for Maintaining a Healthy Credit Score

To navigate through loan consolidation without credit score setbacks, it is crucial to adopt certain practices that promote a healthy credit profile. Here are some strategies to consider:

- Continue Making Payments: Even while your loans are in the process of consolidation, it’s vital to keep making payments on your existing loans. This shows lenders you’re still managing your debt responsibly, which can positively impact your credit score.

- Pay on Time: Timely payments are one of the most significant factors affecting your credit score. Set reminders or automate payments to ensure you never miss a due date during consolidation.

- Avoid Taking on New Debt: While consolidating, refrain from accumulating additional debt. New credit inquiries can lower your score, and accumulating more debt can strain your ability to manage existing loans.

Managing Payments During the Consolidation Process

Managing your payments effectively during the consolidation process can help you maintain credit health. Here are some tips to ensure your payment plan works smoothly:

- Understand Your New Payment Schedule: Once you consolidate, familiarize yourself with the new payment schedule to avoid any surprises. Know when the first payment is due and the amount.

- Consider a Grace Period: Some consolidation options provide a grace period before payments start. Utilize this time to budget and plan for your financial responsibilities.

- Communicate with Lenders: Maintain open communication with your lenders. If you encounter difficulties making payments, reach out to them to discuss your options. They may offer temporary relief or restructuring plans.

Monitoring Credit Scores Throughout the Consolidation Period

Keeping track of your credit score during consolidation is essential for ensuring your efforts to maintain credit health are effective. Here are methods to monitor your score:

- Use Free Credit Monitoring Services: Several companies offer free credit monitoring services that alert you to changes in your credit report. This can help you catch errors early and monitor your score as you consolidate.

- Request Your Credit Report Annually: You are entitled to a free credit report from each of the three major credit bureaus every year. Review your reports for any discrepancies and ensure all information is accurate.

- Utilize Credit Score Tracking Apps: Many apps provide real-time tracking of your credit score and insights into what factors are influencing it. This can be a helpful tool for staying proactive about your credit health.

Maintaining a healthy credit score requires vigilance during the consolidation process. Stay informed and proactive to protect your credit health.

Alternatives to Consolidation

Managing student loans can be daunting, especially when considering consolidation. However, there are several alternatives worth exploring that can help you navigate your financial obligations without resorting to consolidation. These options include refinancing, deferment, and forbearance, each offering unique benefits and challenges that can impact your credit health differently.

Refinancing Student Loans

Refinancing your student loans is an alternative that allows borrowers to replace their existing loans with a new one, typically at a lower interest rate. This process can help reduce monthly payments and the overall cost of borrowing. However, it’s crucial to understand the implications of refinancing on your credit score and loan terms.

When considering refinancing, here are several important factors to keep in mind:

- Lower Interest Rates: Many borrowers can secure a lower interest rate, which can save money over the loan’s life.

- Potential Impact on Credit Score: Applying for a new loan can result in a hard inquiry on your credit report, which might temporarily lower your score.

- Loss of Federal Benefits: If you refinance federal student loans into a private loan, you may lose access to benefits like income-driven repayment plans and loan forgiveness options.

- Flexibility in Terms: Refinancing may allow you to adjust the loan term, potentially lowering monthly payments or shortening the repayment period.

Refinancing can provide financial relief, but borrowers must evaluate the long-term implications on their credit health and remain aware of any lost federal benefits.

Deferment and Forbearance Options

Deferment and forbearance are both temporary relief options that allow borrowers to pause or reduce their payments. While these can provide short-term financial relief, they come with certain pros and cons that can affect overall debt management.

Here’s a closer look at each option:

- Deferment: This option allows you to temporarily stop making payments on your federal student loans, often without accruing interest during the deferment period. This can be beneficial during periods of financial hardship.

- Interest Accrual: For subsidized loans, interest does not accrue during deferment. However, for unsubsidized loans, interest continues to accumulate, which can increase the total amount owed upon resuming payments.

- Forbearance: Forbearance permits borrowers to postpone payments for a limited time, but interest generally accrues during this period for all types of loans.

- Long-Term Consequences: While both options provide temporary relief, extended periods of deferment or forbearance can lead to greater overall debt due to accrued interest, affecting long-term repayment plans.

Deferment and forbearance can provide valuable breathing room, but borrowers must remain vigilant about how these options influence their total debt and payment strategy.

These alternatives to consolidation can be effective tools in managing your student loans. It’s essential to consider your financial situation and long-term goals before deciding on the best path forward. By understanding all available options, you can take control of your student loan journey while safeguarding your credit health.

Common Mistakes to Avoid

When considering student loan consolidation, borrowers often overlook critical aspects that can lead to unfavorable outcomes. Awareness of these common pitfalls can help you make informed decisions and protect your credit health. Avoiding these mistakes can not only streamline your consolidation process but also safeguard your financial future. One of the most frequent errors made during loan consolidation is neglecting to research all available options.

Borrowers may hastily choose a consolidation plan without understanding the terms and potential long-term impacts. Understanding the nuances of each option is crucial for making a sound choice.

Neglecting to Understand Interest Rates

Many borrowers mistakenly believe that consolidating loans will automatically lower their interest rates. In reality, consolidation can sometimes lead to a higher rate depending on the existing loans’ terms. It’s important to compare the weighted average of the interest rates of the loans being consolidated to the new rate offered by the consolidation lender.

“Always calculate the total interest paid over the life of the loan before committing to a consolidation plan.”

Missing Payments During the Process

Another common mistake is failing to stay current on payments during the consolidation process. While your loan is being consolidated, it’s essential to keep making payments on your existing loans until the new loan is confirmed. Missing payments can negatively impact your credit score and lead to unnecessary fees.

Not Considering Federal Repayment Options

Borrowers sometimes overlook federal repayment programs that could provide better options than private consolidation. Federal loans offer repayment plans like Income-Driven Repayment (IDR), which can be more beneficial depending on a borrower’s financial situation.

Ignoring the Impact on Loan Benefits

Consolidation can result in the loss of certain benefits associated with federal loans, such as interest rate discounts, principal rebates, or loan forgiveness options. Careful consideration of these benefits is essential. To avoid these pitfalls, borrowers should:

- Conduct thorough research on interest rates and terms of each consolidation option.

- Maintain regular payment schedules to prevent late fees and credit score damage.

- Explore federal repayment options before opting for private consolidation.

- Assess the potential loss of benefits associated with existing loans.

By being aware of these common missteps and actively working to avoid them, borrowers can navigate the consolidation process more effectively and maintain their credit health.

Last Word

In conclusion, consolidating your student loans may be a beneficial step toward simplifying your finances and maintaining a healthy credit score. By following the Artikeld steps and considering the factors that can influence your credit, you can navigate this process with confidence. Remember, being informed is key—take the time to research your options and avoid common pitfalls, ensuring your journey toward financial stability is as smooth as possible.

Questions Often Asked

What is student loan consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan, often with a new loan term and potentially lower monthly payments.

Will consolidating my loans hurt my credit score?

While consolidation can initially have a small negative impact on your credit score, with proper management, it can lead to improvements over time.

Can I consolidate federal and private loans together?

No, federal loans can only be consolidated through a Direct Consolidation Loan, while private loans must be consolidated separately through a private lender.

What documents do I need to consolidate my loans?

You typically need your loan statements, proof of income, and identification documents, but this can vary by lender.

Are there fees associated with loan consolidation?

Most federal loan consolidations do not have fees, but some private lenders may charge fees, so it’s essential to check before proceeding.

![Best RV Portable Waste Tank [2020] | Top Motorhome Reviews](https://money.narasi.tv/wp-content/uploads/2025/06/BestPicks-350x250.png)