Passive Income Ideas That Actually Work This Year offers a gateway to financial freedom, inviting individuals to explore opportunities that allow money to flow in with minimal ongoing effort. In a world where traditional income routes may feel limiting, passive income serves as a powerful tool in financial planning, encompassing diverse streams such as real estate, stock investments, and digital products.

This year, various passive income ideas have gained traction, each with its unique advantages and challenges. By understanding these concepts and exploring potential avenues, anyone can find the right fit for their lifestyle and financial goals, creating a pathway to sustainable income.

Understanding Passive Income

Passive income is a financial concept that refers to earnings generated with minimal effort or active involvement from the individual. This income stream is crucial in financial planning as it allows individuals to build wealth over time without the constraints of traditional employment. In today’s fast-paced world, creating multiple streams of passive income can provide financial security and freedom, enabling individuals to focus on their passions rather than solely on work.Various types of passive income streams exist, each catering to different interests and skills.

Some common examples include rental income from real estate properties, dividends from stocks, interest from savings accounts or bonds, and royalties from creative works such as books or music. These income streams are essential for diversifying one’s financial portfolio and ensuring a steady inflow of funds without active daily involvement.

Types of Passive Income Streams

Understanding the different types of passive income streams helps individuals identify which options align best with their financial goals and lifestyle. Here are some noteworthy passive income sources:

- Real Estate Rentals: Investing in rental properties can generate consistent income. Owners can earn monthly rent from tenants, and property values may appreciate over time.

- Dividend Stocks: Purchasing shares from established companies that pay dividends can provide regular income without needing to sell the stock. This can contribute to both capital gains and income generation.

- Peer-to-Peer Lending: Engaging in peer-to-peer lending platforms allows individuals to lend money to others, earning interest on the loans, thus generating passive income.

- Royalties: Creators of original content—such as authors, musicians, or software developers—can earn royalties whenever their work is sold or used, leading to ongoing income.

- Online Courses and E-books: Developing educational content can yield passive income once the initial work is completed. Sales can continue long after the course or book is published.

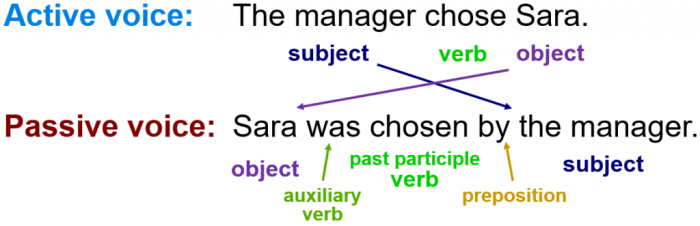

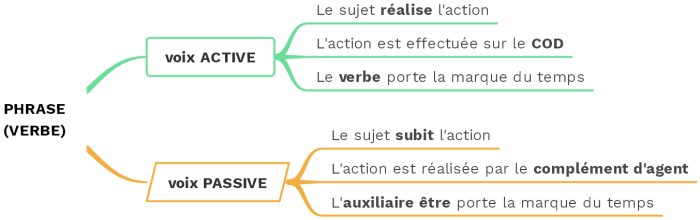

The difference between active and passive income centers around the level of involvement required to earn it. Active income necessitates direct participation in work, such as salaries from a job or payments for services rendered. In contrast, passive income represents earnings that can accumulate without continuous effort.

Active income requires ongoing involvement, whereas passive income can generate revenue without constant attention.

Many individuals aim to transition from a reliance on active income to cultivating diverse passive income streams. This shift not only provides financial stability but also enhances personal freedom, allowing people to dedicate time to other pursuits or investment opportunities.

Popular Passive Income Ideas for 2023

Source: pressbooks.pub

This year has brought forth a variety of passive income opportunities that cater to different interests and investment levels. Exploring these trends can provide potential pathways to financial stability and wealth growth without the requirement of active involvement on a daily basis. Here, we delve into some of the most popular passive income ideas that are making waves in 2023, detailing their pros, cons, and overall potential.

Trending Passive Income Ideas

There are numerous options available for those interested in generating passive income. The following table categorizes these ideas based on their investment levels, associated risks, and potential returns.

| Passive Income Idea | Investment Level | Risk | Potential Returns | Pros | Cons |

|---|---|---|---|---|---|

| Real Estate Investing (REITs) | Moderate | Medium | 5-10% annually | Liquidity, dividends are often paid quarterly. | Market fluctuations can affect dividends. |

| Dividend Stocks | Low to Moderate | Medium | 2-6% annually | Potential for capital appreciation, easily tradable. | Market volatility can affect stock value. |

| Peer-to-Peer Lending | Low | High | 5-15% annually | High returns compared to traditional savings. | Risk of borrower default. |

| Creating an Online Course | Low | Low | Varies widely | Scalable income potential, global reach. | Requires initial time investment to create content. |

| Affiliate Marketing | Low | Medium | Varies widely | Flexibility, low startup costs. | Income can be inconsistent, requires online presence. |

This table helps to highlight the diversity of passive income options available. Each idea comes with its own set of advantages and challenges, making it essential for individuals to choose based on their personal preferences, risk tolerance, and financial goals.

Creating Digital Products

Creating digital products is one of the most effective ways to generate passive income in today’s digital landscape. Unlike physical products, digital products can be easily created, distributed, and sold online with minimal ongoing effort. This means that once your product is launched, it can continue to generate revenue without much additional work on your part. This section will explore how to create and sell digital products, successful examples, and a step-by-step guide to launching your own product.

Successful Digital Products and Their Sales Strategies

The types of digital products that can be created are vast, ranging from eBooks and online courses to software and printables. Many creators have found success by identifying a niche market and tailoring their products to meet specific needs. One well-known example is Pat Flynn, who launched his online course on creating passive income, earning significant revenue through effective marketing strategies such as webinars and email marketing.

Another successful case is Marie Forleo, whose digital programs and courses focus on entrepreneurship; she leverages social media and advice-driven content to build her audience.To effectively sell digital products, consider these strategies:

- Building an Email List: An engaged email list can provide a direct line to your customers and is essential for driving sales.

- Utilizing Social Media: Platforms like Instagram, Facebook, and LinkedIn can foster community and increase product visibility.

- Offering Free Content: Providing free resources or previews can entice customers to purchase the full product.

- Leveraging Affiliate Marketing: Collaborating with affiliates can expand your reach without upfront costs.

Step-by-Step Guide for Launching a Digital Product

Before diving into product creation, it’s crucial to conduct thorough market research to identify your target audience and understand their pain points. Here’s a structured approach to get started:

1. Identify Your Niche

Choose a topic you’re knowledgeable about and passionate about that has potential demand.

2. Conduct Market Research

Use tools like Google Trends or social media surveys to gauge interest and analyze competitors.

3. Develop Your Product

Create your digital product based on the insights gained from your research. Focus on quality and solution-oriented content.

4. Set a Price

Research similar products to determine competitive pricing. Consider the value your product provides and test different price points if necessary.

5. Build a Sales Funnel

Create a dedicated landing page for your product where customers can learn about it and make a purchase. Integrate email marketing for follow-ups.

6. Launch Your Product

Announce your product through your email list and social media platforms, utilizing teasers and countdowns to build excitement.

7. Gather Feedback and Adjust

After launch, collect customer feedback to make improvements and consider running promotions to increase sales.By following this guide, you can effectively create and sell a digital product that generates passive income while providing value to your customers.

Real Estate Investments

Source: salle34.net

Investing in real estate presents numerous opportunities for passive income generation, appealing to both seasoned investors and newcomers. This sector has unique characteristics that allow for consistent cash flow and long-term growth potential, making it an attractive option for building wealth. Understanding the different avenues available for real estate investment is crucial in identifying the best fit for individual financial goals.Real estate offers various passive income opportunities, ranging from traditional rental properties to innovative platforms such as real estate crowdfunding.

Each option has its own set of advantages and challenges, influencing potential returns and management requirements. Traditional rental properties require direct ownership and management, while crowdfunding allows investors to participate in larger projects without the need for direct involvement.

Comparison of Traditional Rental Properties and Real Estate Crowdfunding

When deciding between traditional rental properties and real estate crowdfunding, it is important to consider the different characteristics of each method. Traditional rental properties involve purchasing a physical asset, which can provide steady cash flow through rental income, but also involves responsibilities like property management, maintenance, and potential vacancy risks. On the other hand, real estate crowdfunding allows individuals to invest in real estate projects through online platforms, often with lower capital requirements and less management responsibility.Key points of comparison include:

- Ownership: Traditional rentals offer direct ownership, providing greater control but also increased responsibility. Crowdfunding typically involves shared ownership and limited control over the project.

- Investment Size: Traditional investments often require significant capital for down payments, while crowdfunding allows for smaller investments, making it accessible to a wider audience.

- Management: Rental properties require hands-on management or hiring property managers, whereas crowdfunding usually handles management and maintenance through the platform.

- Returns: Traditional rentals can yield consistent monthly income and potential appreciation, while crowdfunding returns depend on the performance of specific projects but can diversify risk across multiple investments.

Steps Involved in Investing in Real Estate

Investing in real estate can be a rewarding venture, but it requires careful planning and execution. Here are the essential steps involved in the process, from financing to property management:

1. Research and Due Diligence

Begin by researching the market and identifying neighborhoods with growth potential. Analyze property values, rental demand, and economic indicators to make informed decisions.

2. Financing Options

Explore various financing methods, including traditional mortgages, private loans, or partnerships. Understanding your budget and leveraging financing effectively is crucial for maximizing returns.

3. Property Acquisition

Once financing is secured, identify properties that meet your investment criteria. Consider factors such as price, condition, and potential for appreciation or rental income.

4. Property Management

After acquiring the property, decide whether to manage it yourself or hire a property management company. Professional management can streamline operations and reduce the time commitment involved in maintaining the property.

5. Ongoing Assessment

Monitor the property’s performance regularly and reassess your strategy as market conditions change. This might involve adjusting rents, reinvesting in property upgrades, or expanding your portfolio with additional investments.By following these steps, individuals can navigate the complexities of real estate investment and build a sustainable source of passive income.

Stock Market Investments

Investing in the stock market can be a powerful way to generate passive income, particularly through dividends. Dividends represent a portion of a company’s earnings distributed to shareholders, providing a steady income stream while retaining ownership of the stocks. This income can be reinvested, allowing for compound growth over time.Dividends from stocks offer a reliable method to create passive income.

When investing in dividend-paying stocks, investors can benefit from the dual advantage of stock appreciation and regular cash flow. Companies with a robust financial history often pay dividends as a way to reward shareholders, which can be particularly appealing for those looking to build wealth over time without actively managing their investments.

Types of Stocks for Passive Income Generation

Investors seeking dividend income should consider several types of stocks known for their consistent dividend payments. These include:

- Dividend Growth Stocks: Companies that regularly increase their dividends over time, reflecting strong earnings growth and financial stability.

- High-Dividend Yield Stocks: These stocks offer a high percentage return based on their current stock price. However, it’s essential to assess the sustainability of these dividends.

- REITs (Real Estate Investment Trusts): These are companies that own and operate income-producing real estate. By law, they must distribute at least 90% of their taxable income as dividends to shareholders.

- Utility Stocks: Often viewed as reliable investments, utility companies tend to provide steady dividends due to their stable cash flows.

- Preferred Stocks: These stocks often come with fixed dividends and have priority over common stocks in the event of liquidation.

For beginners looking to invest in dividend stocks, here are some useful tips to consider:Firstly, it’s essential to do thorough research before investing. Understanding the company’s financial health, payout ratios, and dividend history can provide insights into the stability of the dividends.

- Understand the

dividend yield

, which is calculated by dividing the annual dividends by the stock’s price. A higher yield can indicate a more attractive investment but requires careful evaluation.

- Focus on companies with a history of

consistent dividend payments

and growth, as these are often more reliable.

- Diversify your portfolio to minimize risk. Investing in various sectors can help protect your income stream from market volatility.

- Consider using a

dividend reinvestment plan (DRIP)

, which allows dividends to be reinvested to buy more shares, compounding your returns over time.

- Keep an eye on the

payout ratio

, which indicates what percentage of earnings is paid out as dividends. A lower ratio may suggest room for future growth.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending has emerged as a popular option for investors seeking passive income. This innovative approach connects borrowers directly with lenders, bypassing traditional financial institutions. As a result, investors can earn attractive returns while helping individuals secure loans for various purposes.P2P lending operates through online platforms that facilitate the matching of borrowers and lenders. Investors can select specific loans based on their risk preferences, loan purpose, and expected returns.

The platforms handle the administrative tasks such as credit checks, payment processing, and collections. This hands-off investment can generate a steady stream of income, but potential investors must be aware of associated risks.

Risks of Peer-to-Peer Lending and Mitigation Strategies

While P2P lending can be lucrative, it is essential to understand the potential risks involved. Key risks include borrower default, platform risk, and economic downturns impacting repayment ability. Implementing effective strategies can help mitigate these risks and enhance the investment’s safety.

- Borrower Default: The risk of borrowers failing to repay their loans is significant. To mitigate this, investors should diversify their portfolios across multiple loans and borrower profiles, reducing the impact of any single default.

- Platform Risk: The financial stability of the P2P platform itself is crucial. Investors should research platforms thoroughly, looking for established companies with a solid track record and robust security measures in place.

- Economic Downturns: Economic shifts can affect borrowers’ ability to repay loans. Investors may consider focusing on loans with lower risk profiles or those secured by collateral to provide an additional layer of protection.

Comparison of Popular Peer-to-Peer Lending Platforms

Choosing the right P2P lending platform is a critical step in starting this investment journey. Below is a comparison of several popular P2P lending platforms, highlighting interest rates and typical borrower profiles.

| Platform | Average Interest Rate | Typical Borrower Profile |

|---|---|---|

| LendingClub | 6% – 35% | Personal loans for credit card debt, home improvement, or medical expenses |

| Prosper | 7% – 36% | Personal loans for major purchases, debt consolidation, or home improvement |

| Funding Circle | 4.99% – 27% | Small business loans for expansion, equipment purchase, or working capital |

| Upstart | 7% – 35% | Personal loans with a focus on education, career, or credit-building |

Affiliate Marketing

Affiliate marketing is a popular method for generating passive income by promoting products or services from various companies and earning a commission for every sale or lead generated through your referral. It allows individuals to monetize their online presence, utilizing links embedded in content, social media platforms, and websites. As a result, it becomes possible to earn money while you sleep, as your affiliate links can continue to generate traffic and sales without constant effort.Successful affiliate marketing relies heavily on a well-defined strategy that includes effective content creation and precise audience targeting.

Quality content that resonates with your audience can significantly enhance your chances of success in affiliate marketing. Additionally, understanding your audience’s needs and preferences allows you to promote products or services that genuinely interest them, leading to higher conversion rates.

Strategies for Successful Affiliate Marketing

Implementing effective strategies is crucial for thriving in affiliate marketing. Below are some key considerations to enhance your approach:

Content Creation

Develop informative and engaging content that provides value to your audience. This could include blog posts, videos, podcasts, and social media content that seamlessly integrates affiliate links. Ensure that your content is authentic and reflects genuine experiences with the products or services you promote.

Audience Targeting

Identify your target audience based on demographics, interests, and online behaviors. Tailoring your marketing efforts to reach specific groups increases the likelihood of engagement and conversions. Use tools like Google Analytics or social media insights to better understand your audience.

Optimization

Optimize your content for search engines by using relevant s and creating high-quality backlinks. This increases the chances of your affiliate content being discovered organically by users searching for related topics.

Social Media Engagement

Leverage social media platforms to promote your affiliate products. Engaging regularly with your followers and sharing valuable insights can help build trust, leading to higher conversion rates.

Email Marketing

Build an email list and utilize it to share valuable content and affiliate promotions. Personalized emails can foster stronger connections with your audience and encourage them to explore the products you recommend.

Tracking Performance

Utilize analytics tools to monitor the performance of your affiliate links. Identifying which strategies yield the best results enables you to refine your approach and focus on what works best.Choosing the right affiliate programs is vital for maximizing your potential earnings. Below is a guide to help you select programs aligned with your niche markets:

Guide to Choosing the Right Affiliate Programs

Selecting suitable affiliate programs can greatly influence your success. Consider the following factors when making your choice:

Relevance to Your Niche

Choose affiliate programs that align with your content and audience interests. Promoting products that resonate with your niche increases the likelihood of conversions.

Commission Structure

Examine the commission rates and payment terms of various affiliate programs. Look for programs that offer competitive rates and timely payments to maximize your earnings.

Product Quality

Promote only high-quality products or services that you believe in. Your reputation is on the line, and recommending products that deliver value enhances trust and credibility with your audience.

Brand Reputation

Research the brands behind the affiliate programs. Partnering with reputable brands can boost your credibility and ensure a smoother experience for your audience.

Support and Resources

Evaluate the support offered by the affiliate program, including promotional materials, training, and affiliate management. Strong support can make it easier to succeed as an affiliate partner.

Tracking and Reporting

Ensure the affiliate program provides robust tracking and reporting tools. Understanding how your affiliate links perform will help you optimize your strategies.By following these guidelines, you can build a successful affiliate marketing venture that generates a sustainable passive income stream while providing value to your audience.

Automated Online Businesses

Creating an automated online business has become an increasingly attractive option for generating passive income. This model allows entrepreneurs to set up systems that operate with minimal ongoing effort, enabling them to focus on other ventures or enjoy their free time. By leveraging technology, anyone can build a business that works for them, even while they sleep.When considering automated online businesses, various models can be explored.

Dropshipping and print-on-demand are two popular options. Dropshipping involves selling products without holding inventory; suppliers ship directly to customers. In contrast, print-on-demand allows entrepreneurs to customize products like t-shirts or mugs, which are only created after a sale is made. Both models have their unique advantages, including low startup costs and the ability to scale quickly.

Steps for Setting Up an Automated Online Business

Establishing an automated online business requires careful planning and the right tools. Below is a step-by-step process to get you started.

1. Choose Your Niche

Selecting a niche is crucial as it defines your target audience and influences product selection. Research trends and interests to identify a profitable niche.

2. Select a Business Model

Decide between dropshipping, print-on-demand, or another model based on your interests and market research.

3. Set Up Your Online Store

Use platforms like Shopify, WooCommerce, or Etsy to create your e-commerce site. These platforms offer user-friendly interfaces and essential tools for automation.

4. Integrate Automation Tools

Utilize apps that streamline order processing, inventory management, and customer service. For example, Oberlo for dropshipping or Printful for print-on-demand can help automate key tasks.

5. Create Marketing Strategies

Develop a marketing plan to drive traffic to your site. Utilize social media, email marketing, and search engine optimization () to reach your audience effectively.

6. Launch Your Business

Once everything is set up, launch your online store. Monitor performance and make adjustments as needed to improve sales.

7. Analyze and Optimize

Use analytics tools to track your store’s performance. This data can help you refine marketing efforts and enhance customer experience.

“An automated online business allows you to generate income with minimal ongoing effort.”

By following these steps, you can create a sustainable automated online business that not only provides passive income but also offers flexibility and growth potential. With the right systems in place, your business can thrive, allowing you to reap the rewards of your hard work while enjoying your lifestyle.

Content Creation and Monetization

Creating content that generates passive income can be both rewarding and lucrative. With the right strategy, platforms like blogs and YouTube can transform your passions into revenue streams. By focusing on high-quality content and consistent engagement, you can build an audience that not only consumes your content but also supports your efforts financially.Monetizing your content effectively involves various methods such as displaying ads, securing sponsorships, and selling merchandise.

Each method offers unique advantages and can complement one another to maximize your income potential. Understanding these options will help you tailor your approach based on your strengths and audience preferences.

Creating Consistent and Engaging Content

Establishing a consistent content schedule is crucial for audience engagement and retention. Here’s a structured plan to help maintain consistency and keep your audience coming back for more:

- Define Your Niche: Focus on a specific area of interest that resonates with you and your audience. This helps build a loyal following.

- Create a Content Calendar: Plan your content ahead of time, including topics, formats, and publishing dates to ensure regular posting.

- Engage with Your Audience: Respond to comments and messages, and encourage feedback to foster a sense of community around your content.

- Utilize Strategies: Implement search engine optimization techniques to increase the visibility of your content and attract organic traffic.

- Experiment with Different Formats: Try various content types such as videos, podcasts, and written articles to see what resonates best with your audience.

- Leverage Social Media: Promote your content across various social media platforms to reach a wider audience and drive traffic back to your main content.

- Analyze Performance: Use analytics tools to track engagement metrics and adjust your strategy based on what works best.

“Consistent content creation, paired with audience engagement, lays the foundation for successful monetization.”

By focusing on these strategies, you can create a sustainable content creation process that not only builds your brand but also leads to passive income opportunities through monetization.

Exploring Other Passive Income Streams

In a world where the quest for financial freedom is more popular than ever, it’s essential to explore a variety of passive income opportunities beyond the standard options. This section highlights some less common passive income ideas that are gaining traction and provides insights on how to identify and evaluate these opportunities effectively.Understanding new passive income streams can provide significant benefits, especially as the market evolves and technology progresses.

Researching and evaluating these ideas requires a proactive approach to ensure that your investments are sound. Additionally, diversifying your passive income sources can mitigate risks and maximize returns, creating a more robust financial portfolio.

Emerging Passive Income Ideas

While many people are familiar with traditional options, several emerging passive income ideas are gaining popularity. Here are a few to consider:

- Print on Demand: This model allows you to create custom designs for items like t-shirts, mugs, and posters, which are printed and shipped only when ordered, minimizing upfront costs.

- Online Courses: With the rise of e-learning, creating and selling online courses in your area of expertise can generate passive income while helping others learn.

- Subscription Services: Offering exclusive content, products, or services on a subscription basis can create a steady income stream and build a loyal customer base.

- Mobile Apps: Developing and monetizing a mobile app can lead to passive income through ads, in-app purchases, or subscriptions, especially if the app fills a unique niche.

- Digital Assets: Investing in digital assets like domain names or websites can yield passive income through leasing or selling them at a profit.

Researching and evaluating these opportunities requires a strategic approach. Consider the following factors:

Research and Evaluation Methods

To navigate the landscape of passive income opportunities effectively, researching and evaluating potential investments is crucial. Here are some strategies to employ:

- Market Trends Analysis: Stay informed about market trends by following industry reports, expert blogs, and social media discussions, which can help you identify emerging opportunities.

- Networking: Engage with communities of entrepreneurs and investors, both online and offline, to gain insights and advice on different passive income streams.

- Testing Small Investments: Test out new ideas with small investments to gauge their potential before committing significant resources.

- Performance Tracking: Regularly assess the performance of your passive income streams to identify areas for improvement or diversification.

Importance of Diversification

Diversification is a critical element in building a successful portfolio of passive income streams. By spreading your investments across various avenues, you can reduce risk and enhance overall returns.

“Diversifying your passive income sources can protect you from market fluctuations and create a more stable income flow.”

To achieve diversification, consider the following approaches:

- Mixing Asset Classes: Combine different types of assets, such as stocks, real estate, and digital products, to mitigate risk.

- Geographic Diversification: Invest in markets across different regions to reduce exposure to local economic conditions.

- Varying Time Horizons: Include both short-term and long-term investments in your portfolio to balance immediate cash flow needs with future growth potential.

Closing Summary

Source: comoaprenderinglesbien.com

In conclusion, embracing Passive Income Ideas That Actually Work This Year can significantly enhance your financial portfolio and provide the freedom to pursue your passions. From real estate to digital products and everything in between, the possibilities are endless. The key lies in taking the first step, researching your options, and diversifying your income streams for lasting success.

Detailed FAQs

What is passive income?

Passive income refers to earnings derived from ventures in which a person is not actively involved, allowing money to come in with little ongoing effort.

How much can I earn from passive income streams?

Earnings from passive income can vary widely based on the type of investment, market conditions, and the amount of initial effort and capital invested.

Is it possible to create passive income with no money?

While many passive income opportunities require an initial investment, some options, like affiliate marketing or content creation, can be started with little to no money.

How do I choose the right passive income stream for me?

Consider your interests, available time, risk tolerance, and investment capabilities to find a passive income stream that aligns with your lifestyle and goals.

How long does it take to start earning passive income?

The timeline for earning passive income can vary; some streams may generate income quickly, while others require more time to establish before yielding returns.

![Ufit:index [MLZ - Wiki]](https://money.narasi.tv/wp-content/uploads/2025/06/faa25d526aee0c35e409a2fb33531950-350x250.jpg)

![Best RV Portable Waste Tank [2020] | Top Motorhome Reviews](https://money.narasi.tv/wp-content/uploads/2025/06/BestPicks-120x86.png)