Beginner’s Guide to Investing in Index Funds promises to unravel the mysteries of a powerful investment tool that has gained popularity among both novice and seasoned investors alike. Imagine a strategy that offers simplicity, diversification, and potential for growth—all while keeping costs low. Index funds are designed to track a specific market index, providing investors with a straightforward way to participate in broader market movements without the need for constant management or oversight.

In this guide, we’ll explore the essentials of index funds, from understanding their key features to the benefits they bring compared to traditional actively managed funds. Whether you are just starting out or looking to enhance your investing knowledge, this guide will provide you with a solid foundation for smart investing decisions.

Introduction to Index Funds

Source: solofinancee.com

Index funds are a type of mutual fund or exchange-traded fund (ETF) designed to replicate the performance of a specific market index, such as the S&P 500. Their primary purpose is to provide investors with a simple, low-cost way to gain exposure to a diversified portfolio of stocks or bonds, reflecting the broader market’s movements without the need for active management.The concept of index funds originated in the early 1970s, with the first index fund being introduced by Vanguard founder John C.

Bogle in 1976. This innovative approach revolutionized investing by offering a passive investment strategy that aimed to match market returns rather than trying to outperform them. Over the decades, index funds gained popularity, especially as investors began to recognize the benefits of lower fees and the consistent performance they could offer compared to actively managed funds.

Key Characteristics of Index Funds

Index funds exhibit several defining characteristics that set them apart from other investment vehicles, making them an attractive option for investors. Understanding these features is essential for anyone considering adding index funds to their investment portfolio.

- Passive Management: Index funds are passively managed, meaning they aim to mirror the performance of a specific index rather than relying on active stock-picking strategies. This leads to lower management fees because there is less trading activity involved.

- Diversification: By investing in an index fund, investors can gain exposure to a wide range of securities within the index, which helps spread risk. For example, an S&P 500 index fund includes shares from 500 of the largest U.S. companies, offering built-in diversification.

- Lower Costs: Index funds typically have lower expense ratios compared to actively managed funds. This is largely due to their passive nature, resulting in fewer trades and management costs, which can translate to higher returns for investors in the long run.

- Tax Efficiency: Index funds generally have lower turnover rates, which can result in fewer taxable events. This tax efficiency can be advantageous for investors looking to minimize their tax liabilities on capital gains.

- Performance Consistency: While active funds might occasionally outperform the market, research has shown that most active managers fail to consistently beat their benchmarks. Index funds offer a steady performance that mirrors the market, making them a reliable choice for long-term investors.

Benefits of Investing in Index Funds

Investing in index funds has become increasingly popular, especially among novice investors seeking a straightforward and effective way to grow their wealth. By tracking a specific index, such as the S&P 500, these funds offer a unique blend of simplicity, diversification, and potential for long-term growth, making them an attractive option compared to actively managed funds.One of the significant advantages of index funds lies in their inherent cost-effectiveness.

Unlike actively managed funds that require a team of analysts and managers to make investment decisions, index funds simply replicate the performance of a specific market index. This results in lower management fees and expenses, which can significantly enhance overall returns for investors.

Cost-Effectiveness of Index Funds

The cost structure of index funds is a crucial factor that contributes to their appeal. The majority of index funds have lower expense ratios compared to their actively managed counterparts. Here’s how this plays out:

Lower Management Fees

Index funds typically charge less in management fees since they do not require active stock picking and research. For instance, while the average expense ratio for actively managed funds hovers around 1% or more, many index funds offer expenses as low as 0.1% or even lower.

Reduced Transaction Costs

Since index funds trade less frequently than actively managed funds, they incur fewer transaction costs. This is important because high trading fees can erode investment returns over time.

Tax Efficiency

Index funds tend to be more tax-efficient due to their lower turnover rates. When a fund frequently buys and sells assets, it can realize capital gains that are taxable to investors. Index funds, with their buy-and-hold strategy, minimize this issue, resulting in fewer tax liabilities for investors.

“Keeping investment costs low is one of the most effective ways to increase investment returns over time.”

Potential for Long-Term Growth

Investing in index funds is also associated with strong potential for long-term growth. Historical data suggests that, over time, the stock market has generally trended upwards, making index funds an appealing option for growth-oriented investors.

Market Performance

Studies show that many actively managed funds fail to outperform their benchmark indices over extended periods. A well-known report from SPIVA (S&P Indices Versus Active) consistently demonstrates that a majority of active managers underperform their benchmarks over 5- and 10-year periods.

Diversification Benefits

By investing in index funds, investors gain exposure to a broad array of stocks within a specific index. This diversification helps reduce risk, as the poor performance of a few individual stocks is often offset by the stronger performance of others in the index.

Consistency and Simplicity

Index funds offer a straightforward investment strategy, as investors do not need to worry about timing the market or selecting individual stocks. This consistency can lead to more disciplined investing habits, fostering long-term growth.In summary, the benefits of investing in index funds encompass cost-effectiveness, lower fees, tax efficiency, long-term growth potential, and the simplicity of a diversified investment strategy.

These factors make index funds an ideal choice for beginner investors aiming to build a robust investment portfolio over time.

Types of Index Funds

Index funds come in various flavors, each designed to cater to different investment goals and strategies. Understanding the different types available can help you make informed decisions and align your investments with your financial objectives. Let’s explore the diverse range of index funds that investors can choose from, including their specific focuses and functionalities.

General Market Index Funds

General market index funds are designed to track broad market indices, providing investors with exposure to a wide array of stocks. These funds typically mirror the performance of well-known indices, making them a popular choice for many investors.

- S&P 500 Index Funds: These funds track the S&P 500 index, which comprises 500 of the largest publicly traded companies in the U.S. Notable examples include the Vanguard 500 Index Fund (VFIAX) and the Fidelity 500 Index Fund (FXAIX).

- Dow Jones Industrial Average Funds: These funds aim to replicate the performance of the Dow Jones Industrial Average, which consists of 30 significant U.S. companies. A popular option is the SPDR Dow Jones Industrial Average ETF Trust (DIA).

- NASDAQ-100 Index Funds: These funds track the performance of the 100 largest non-financial companies listed on the NASDAQ stock market. An example is the Invesco QQQ ETF (QQQ).

International Index Funds

International index funds provide investors with exposure to global markets outside the United States, allowing for broader diversification. These funds can focus on specific regions or countries.

- MSCI Emerging Markets Index Funds: These funds invest in stocks from emerging economies. The iShares MSCI Emerging Markets ETF (EEM) is a well-known option.

- MSCI EAFE Index Funds: Covering Europe, Australasia, and the Far East, funds like the iShares MSCI EAFE ETF (EFA) focus on developed international markets.

Specialized Index Funds

Specialized index funds are tailored to track specific sectors or themes within the market. These funds can be an excellent way to capitalize on particular trends or industries.

- Sector-Specific Funds: Funds like the Financial Select Sector SPDR Fund (XLF) focus exclusively on the financial sector, while the Health Care Select Sector SPDR Fund (XLV) targets healthcare companies.

- Real Estate Index Funds: These funds invest in real estate investment trusts (REITs), providing exposure to the real estate sector. A popular choice is the Vanguard Real Estate ETF (VNQ).

- Socially Responsible Index Funds: Funds like the iShares MSCI KLD 400 Social ETF (DSI) focus on companies with strong environmental, social, and governance (ESG) practices.

Investing in different types of index funds allows for diversification, which can reduce risk and improve overall portfolio performance.

How to Start Investing in Index Funds

Source: evolution-funds.com

To successfully start investing in index funds, you need to follow a few essential steps that pave your way toward building a diversified investment portfolio. This process involves choosing a suitable brokerage firm, opening an investment account, and selecting the right index funds that align with your financial goals. Let’s delve into each of these steps.

Choosing a Brokerage Firm

Selecting the right brokerage firm is a critical first step in your investment journey. The right broker will provide you with the necessary tools and resources to effectively invest in index funds. Here are some factors to consider:

- Fees and Commissions: Look for firms that offer low fees, as high costs can eat into your investment returns over time. Many platforms now offer commission-free trades on index funds.

- Investment Options: Ensure the brokerage provides a wide array of index funds, including those that track different sectors or market indices.

- User Experience: A user-friendly platform can enhance your investing experience, especially if you are new to the process. Check for features like mobile access and educational resources.

- Customer Support: Reliable customer service is important for resolving any issues or questions that may arise while investing.

Opening an Investment Account

Once you’ve selected a brokerage firm, the next step is to open an investment account. This process typically involves the following:

- Application Form: Complete an online application form where you will provide personal information such as your name, address, Social Security number, and employment details.

- Account Type: Choose the type of account you want to open, whether it’s an individual brokerage account, a retirement account like an IRA, or a joint account.

- Verification: Verify your identity by submitting required documents, which may include a copy of your ID or utility bill.

- Funding the Account: After your account is approved, fund it through bank transfers, wire transfers, or checks. Make sure to understand any minimum deposit requirements.

Selecting Index Funds Based on Financial Goals

Choosing the right index funds is paramount to aligning your investments with your financial objectives. Here’s how to make informed selections:

- Define Your Goals: Consider whether you are investing for long-term growth, retirement, or short-term financial needs. This will guide your fund selection.

- Evaluate Fund Performance: Research the historical performance of various index funds. While past performance doesn’t guarantee future results, it can provide insights into a fund’s reliability.

- Consider Expense Ratios: Look for funds with low expense ratios, as these costs can significantly impact your net returns over time. A fund with a 0.05% expense ratio will typically outperform one with a 1% ratio over the long haul.

- Assess Asset Allocation: Choose funds that complement each other to diversify your portfolio effectively. This means considering the sectors or market caps the index funds target.

Investing in index funds allows you to diversify your portfolio at a lower cost, making it an attractive option for both beginner and seasoned investors.

Understanding Risk and Return

Investing in index funds is often touted as a straightforward approach to building wealth, but it’s important to understand the associated risks and returns. Being aware of potential pitfalls and the historical performance of index funds compared to other investments can help you make informed decisions. This section dives into the essential elements of risk factors, historical returns, and the role of diversification in managing investment risks.

Risk Factors Associated with Investing in Index Funds

Investing in index funds carries specific risks, similar to other types of investments. Key risk factors include:

- Market Risk: Index funds are subject to market fluctuations. The value of your investment can decline if the overall market experiences a downturn. This risk is inherent to all equity investments.

- Tracking Error: While index funds aim to replicate the performance of their benchmark index, discrepancies can arise due to management fees, fund expenses, or other operational factors. The tracking error may affect the returns you receive.

- Concentration Risk: Some index funds may focus heavily on specific sectors or companies, leading to concentrated exposure. If that sector underperforms, your investments may suffer disproportionately.

Understanding these risks helps investors prepare for potential market volatility and align their investment strategies accordingly.

Historical Returns of Index Funds Compared to Other Investments

Historically, index funds have provided competitive returns when compared to actively managed funds and other investment vehicles. For instance, over the last few decades, the S&P 500 index has delivered an average annual return of roughly 10-11%, making it a robust option for long-term investors. In contrast, many actively managed funds struggle to consistently outperform their benchmark indices, often due to higher fees and management costs.The performance of index funds has also been compared to bonds and real estate:

- Bonds: Generally, bonds offer lower returns compared to equities. While they provide stability and are less volatile, the average annual return on bonds has hovered around 5-6% historically.

- Real Estate: Real estate investments can yield returns in the range of 8-10%, but investing in property requires significant capital and management effort, making index funds a more accessible option for many investors.

This historical context illustrates that while index funds may involve risks, their potential for returns often outweighs those of traditional investment options.

Importance of Diversification in Managing Investment Risks

Diversification is a critical strategy for mitigating risks in your investment portfolio, especially with index funds. By spreading investments across various asset classes, sectors, and geographic regions, investors can reduce the impact of any single investment’s poor performance on their overall portfolio. Key aspects of diversification include:

- Asset Class Diversification: Investing in a mix of stocks, bonds, and other assets can help stabilize returns. While stocks may be volatile, bonds can provide a safety net during market downturns.

- Sector Diversification: Index funds that cover multiple sectors can help guard against sector-specific downturns. For example, if technology stocks decline, investments in healthcare or consumer goods may still perform well.

- Geographic Diversification: Allocating funds to international markets can expose investors to growth opportunities outside the domestic economy, further reducing risk.

Incorporating diversification into your investment strategy is essential for managing risk while pursuing growth, and index funds often provide an efficient vehicle for achieving this goal.

Common Mistakes to Avoid

Investing in index funds can be a rewarding experience, but beginners often stumble upon common pitfalls that can hinder their progress. Understanding these mistakes is the first step toward creating a successful investment strategy. By being aware of these missteps, you can navigate the world of index funds with confidence and clarity.One significant mistake new investors make is allowing emotions to drive their decisions.

The stock market can be volatile, and the fear of loss or the excitement of gains may lead to impulsive choices. To cultivate a successful investment mindset, it’s crucial to establish and stick to a long-term plan and avoid reacting to short-term market fluctuations.

Emotional Decision-Making in Investing

Investing should be governed by logic and research rather than emotions. Beginners often fall into the trap of reacting to market changes, which can lead to poor decisions. Recognizing this tendency is essential. Here are some strategies to avoid emotional decision-making:

- Set clear investment goals: Define your objectives and time horizon for investing. This clarity helps keep you focused on your long-term strategy.

- Develop a diversified portfolio: Spreading investments across various index funds can minimize risk and reduce the temptation to react to individual fund performance.

- Automate contributions: Regular, automated contributions to your investment accounts can help you stick to your plan, regardless of market conditions.

- Limit news consumption: Constantly checking the news can heighten emotional reactions. Consider reducing the frequency of your market updates to maintain a more stable perspective.

Maintaining a long-term perspective is crucial in investing. The market’s short-term volatility can be unsettling, but history shows that markets tend to rise over the long haul.

Importance of a Long-Term Perspective

Investors should resist the urge to make frequent changes to their portfolios based on short-term market trends. Here are some key points highlighting the importance of maintaining a long-term outlook:

- Compounding returns: The longer money is invested, the more it can grow through compounding. Even small, consistent contributions can lead to significant wealth over time.

- Market recovery: Markets will experience downturns, but a long-term perspective allows investors to ride out these phases without panic selling.

- Reduced transaction costs: Frequent trading can incur high fees and taxes. A buy-and-hold strategy minimizes costs and maximizes potential returns.

- Emotional stability: Staying the course can help you avoid the emotional rollercoaster associated with market fluctuations. This discipline fosters a more rational investment approach.

“Successful investing is about managing risk and maintaining a long-term perspective, rather than chasing short-term gains.”

Monitoring and Adjusting Your Portfolio

Regularly reviewing and monitoring your index fund investments is essential for ensuring that your investment strategy aligns with your financial goals. The market is dynamic, influenced by various factors such as economic trends, interest rates, and global events. By staying informed, you can make informed decisions about whether to maintain your current strategy or make necessary adjustments.Assessing the performance of your index funds over time allows you to identify trends and evaluate how well your investments are performing against market benchmarks.

This process includes comparing your investment returns to the performance of relevant indices, considering the overall market conditions, and determining whether your portfolio is meeting your long-term objectives.

Performance Assessment Criteria

To effectively assess the performance of your index funds, it’s important to consider a variety of metrics. The following points are crucial for a comprehensive evaluation:

- Return on Investment (ROI): Calculate the ROI by comparing the gains or losses from your index funds relative to your initial investment amount. This simple calculation can provide a quick insight into performance.

- Benchmark Comparisons: Regularly compare your index fund’s performance with its benchmark index. For instance, if you are invested in an S&P 500 index fund, measure its returns against the S&P 500 itself.

- Expense Ratios: Monitor the expense ratios of your index funds. High fees can eat into your returns, so it’s important to keep these costs in check.

- Volatility and Drawdown: Assess the volatility of your investments by analyzing the standard deviation of returns and identifying historical drawdowns to understand the risk level associated with your index funds.

- Time Horizon Considerations: Evaluate your investments based on your specific time horizon. Short-term fluctuations may not be as critical for long-term investors, but they should still be monitored.

Making adjustments to your investment strategy may be necessary as you review your portfolio. Factors such as changes in your financial goals, risk tolerance, or significant life events (like a new job or retirement) can necessitate a reevaluation of your investment strategy.

When to Adjust Your Investment Strategy

Recognizing the right moments to make adjustments can help in optimizing your portfolio. Consider the following situations:

- Market Changes: If market conditions shift significantly, such as economic downturns or booms, evaluate how your index funds are positioned to respond to these changes.

- Changes in Financial Goals: If your financial goals evolve, such as aiming for early retirement or saving for a major purchase, your investment strategy should reflect these priorities.

- Performance Review: If an index fund consistently underperforms its benchmark over an extended period, it may be time to consider reallocating those funds to a more effective option.

- Portfolio Rebalancing: Regularly rebalance your portfolio to maintain your desired asset allocation. This may involve selling some of your higher-performing funds and buying more of your underperforming ones.

“Successful investing is about managing risk rather than avoiding it.”

Additional Resources for Investors

Investing in index funds is just the beginning of your financial journey. To enhance your knowledge and improve your investment strategies, it’s essential to tap into various resources. This section provides a curated list of books, online resources, financial news outlets, and online communities where investors can connect and share insights.

Recommended Books and Online Resources

Books and online resources are crucial for deepening your understanding of index fund investing. The right materials can provide both foundational knowledge and advanced strategies to optimize your investment portfolio.

- The Little Book of Common Sense Investing by John C. Bogle – This classic book offers insights from the founder of Vanguard and emphasizes the effectiveness of index funds.

- A Random Walk Down Wall Street by Burton Malkiel – A well-known guide that explains investing principles, including the benefits of index funds.

- Investing for Dummies by Eric Tyson – This comprehensive guide covers various investment strategies, with a section dedicated to index funds.

- Morningstar

-An excellent online resource for investment research, offering ratings and analyses of index funds. - Investopedia

-A go-to website for financial education, featuring extensive articles and tutorials on index funds and investing strategies.

Financial News Outlets

Staying informed about the financial market is essential for any investor. Reliable financial news outlets offer real-time insights and analyses that can help you make informed decisions regarding your index fund investments.

- The Wall Street Journal

-Provides in-depth reporting on financial markets, including investment trends and analysis of index funds. - Bloomberg

-Features news, data, and analysis on global financial markets, including valuable insights on index investing. - CNBC

-Offers up-to-date financial news with frequent coverage of investment strategies and market movements. - Yahoo Finance

-A user-friendly platform that provides stock market news, including information relevant to index funds.

Online Communities and Forums

Engaging with other investors can provide valuable insights and different perspectives on index fund strategies. Online communities and forums allow for the exchange of ideas, experiences, and advice.

- Bogleheads Forum

-A dedicated community for investors following the principles of John Bogle, focusing on index fund investing. - Reddit – r/investing

-A popular subreddit where users discuss various investment topics, including index funds, sharing strategies and experiences. - Morningstar Community

-An active forum where investors can discuss mutual funds and index funds, ask questions, and share insights. - Investing.com Forum

-A platform for investors to discuss market trends and investment strategies, including index fund investments.

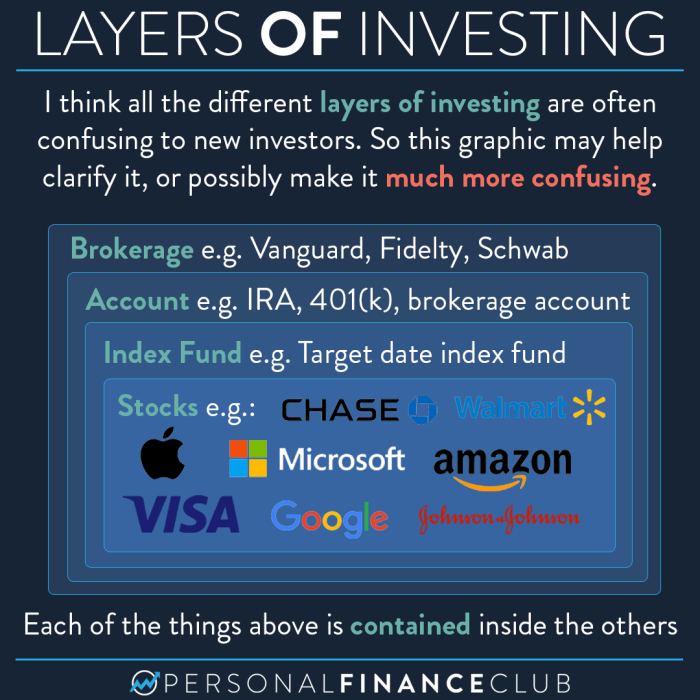

Conclusion

Source: personalfinanceclub.com

As we wrap up this exploration of index funds, it’s clear that they offer a unique opportunity for investors seeking a balanced and cost-effective approach to building wealth. By understanding the types of index funds, the risks involved, and how to avoid common pitfalls, you can position yourself for long-term success in the investment landscape. Remember, the journey doesn’t end here—continuous learning and monitoring will set you on the path to achieving your financial goals.

User Queries

What are index funds?

Index funds are mutual funds or exchange-traded funds (ETFs) designed to replicate the performance of a specific market index, offering broad market exposure with lower costs.

How do I choose the right index fund?

Consider factors like your investment goals, expense ratios, the index being tracked, and performance history when selecting the right index fund.

Are index funds safe for beginners?

While no investment is entirely risk-free, index funds are generally considered a safer option due to their diversified nature, which helps mitigate risk.

How often should I invest in index funds?

Regular contributions, such as monthly or quarterly, can help grow your investment through dollar-cost averaging, reducing the impact of market volatility.

Can I lose money investing in index funds?

Yes, it is possible to lose money in index funds, especially in the short term, but historically they have provided solid returns over the long term.

![Ufit:index [MLZ - Wiki]](https://money.narasi.tv/wp-content/uploads/2025/06/faa25d526aee0c35e409a2fb33531950-350x250.jpg)