In today’s fast-paced business landscape, selecting the right credit card is vital for entrepreneurs looking to optimize their finances. Best Business Credit Cards with No Annual Fees not only lighten the burden of monthly expenses but also provide various perks that can significantly enhance cash flow management. With a growing number of small businesses relying on credit cards for operational needs, understanding the advantages of no annual fee options has become increasingly important.

These cards offer unique benefits such as reward points and cashback without the worry of annual costs. With statistics showcasing a surge in credit card usage among small business owners, it’s clear that making an informed choice can lead to greater financial success.

Introduction to Business Credit Cards

Business credit cards serve as an essential financial tool for small businesses, offering entrepreneurs the flexibility and convenience to manage expenses effectively. These cards are designed specifically for business needs, helping to separate personal and business finances while facilitating smoother cash flow management. They can also aid in building a business credit profile, which is crucial for securing loans and better interest rates in the future.Choosing a business credit card with no annual fees can provide significant savings, allowing small business owners to allocate their resources more efficiently.

This type of card eliminates the burden of an upfront fee, making it more accessible for startups and smaller enterprises. Moreover, these cards often come with rewards programs, cashback offers, and other perks that can enhance the overall value they provide, making it easier for business owners to earn rewards on their everyday spending without the worry of extra charges.Statistics show that approximately 70% of small businesses utilize credit cards for their financing needs, with many opting for cards that do not carry annual fees.

This trend highlights the popularity of no-annual-fee options among entrepreneurs who are looking to minimize costs while still gaining access to essential financial services. According to a recent survey, over 50% of small business owners reported that using a business credit card has helped them manage cash flow better, and nearly 40% stated that it has played a pivotal role in funding their operations during challenging times.

Specific Benefits of No Annual Fee Business Credit Cards

Selecting a business credit card without an annual fee comes with various advantages that can directly impact a business’s bottom line. These benefits can be critical for small businesses operating on tight budgets.

- Cost Savings: Avoiding an annual fee means that every dollar spent on the card goes directly toward business expenses without the overhead cost associated with maintaining the card.

- Cash Flow Management: Without the burden of an annual fee, companies can allocate funds for inventory, marketing, or other critical areas that require immediate attention.

- Ease of Use: Many no-annual-fee cards offer user-friendly services, such as online account management and spending analytics, which help business owners track their expenses more effectively.

- Flexible Payment Options: These cards often come with features like introductory 0% APR on purchases, which allows businesses to make larger purchases without incurring interest charges right away.

- Rewards Programs: No-annual-fee credit cards frequently offer rewards and cashback on purchases, which can contribute to overall savings and enhance the profitability of business operations.

“Small businesses that leverage credit responsibly can discover newfound financial flexibility that can foster growth and innovation.”

Key Features of Best Business Credit Cards

Source: publicdomainpictures.net

Finding the right business credit card can significantly impact your company’s financial health and operational efficiency. When evaluating options, it’s essential to identify key features that align with your business needs. A great business credit card not only provides financial flexibility but also offers rewards and benefits that can enhance your business operations.One crucial aspect to consider is the rewards programs and cashback offers associated with business credit cards.

These features can provide substantial savings and benefits that contribute to your bottom line. Moreover, understanding the credit limits offered can help manage your business spending effectively, ensuring that you have the necessary funds when you need them.

Rewards Programs and Cashback Offers

Rewards programs and cashback offers are vital components of many business credit cards. They allow business owners to earn points or cash back on everyday purchases, which can lead to significant cost savings over time. The benefits of rewards programs include:

- Points Accumulation: Many business credit cards enable you to earn points on every dollar spent, which can be redeemed for travel, merchandise, or statement credits. For instance, a card offering 2x points on office supplies can be advantageous for businesses that regularly purchase these items.

- Cashback Opportunities: Some cards provide a percentage of cashback on all purchases or specific categories like gas, dining, or travel. For example, a card that gives 1.5% cashback on all purchases can lead to substantial returns for a business that spends frequently.

- Bonus Offers: New cardholders may receive attractive sign-up bonuses, such as earning a certain number of points or cashback after spending a specific amount within the first few months. These bonuses can provide a quick financial boost.

“Choosing a card that aligns with your spending habits can maximize your rewards potential.”

Importance of Credit Limits

The credit limit of a business credit card is another critical feature that can influence your financial decisions. It determines how much you can charge to the card and can affect cash flow management.Understanding credit limits involves:

- Spending Flexibility: A higher credit limit enables businesses to manage large purchases or unexpected expenses without hindering cash flow. For instance, if a company needs to buy new equipment, having a higher limit can accommodate this without the need for immediate cash.

- Impact on Credit Score: Utilizing a significant portion of your credit limit can negatively affect your credit score. It’s advisable to keep your credit utilization ratio below 30% to maintain a healthy credit profile.

- Growth Potential: As your business grows, having a higher credit limit can support increased spending needs. This can also facilitate better cash flow management during expansion phases or seasonal spikes in business activity.

“A business credit card with a suitable limit can provide the financial breathing room necessary for growth.”

Advantages of No Annual Fees

When it comes to selecting a business credit card, the financial implications of annual fees can significantly impact your decision. Cards that charge no annual fees provide substantial advantages, especially for small businesses looking to manage costs effectively. By eliminating these fees, businesses can maximize their cash flow and allocate resources to other essential areas.The absence of an annual fee means that every dollar spent on the card contributes directly to the business’s financial health.

This can be particularly beneficial for small businesses that may operate on tighter budgets, allowing them to avoid unnecessary expenses. For example, if a business owner spends $1,000 on a credit card with a $100 annual fee, they effectively start off with a loss of 10%. In contrast, a no-annual-fee card ensures that all spending contributes positively to the business’s bottom line.

Impact on Spending and Usage

No annual fee cards can lead to increased utilization among cardholders, fostering more frequent card use. When businesses do not have to worry about annual fees, they may feel more comfortable using their credit cards for everyday expenses, travel, and other business-related activities. This can lead to several advantages:

Enhanced Cash Flow Management

Without the burden of an annual fee, businesses can invest more in operations or savings. For instance, a business that spends $5,000 annually on a no-fee card has that entire amount available for reinvestment, unlike a card with a fee that reduces available cash.

Encouragement of Frequent Purchases

Small businesses often hesitate to use credit cards for smaller expenses due to potential fees. A no-annual-fee card encourages business owners to use their cards for everyday purchases, potentially leading to rewards or cash back that can further benefit their finances.

Flexibility in Financial Planning

Without the annual fee, businesses gain flexibility in budgeting. They can allocate funds to more critical areas such as marketing or inventory without worrying about fixed credit card expenses.

Improved Credit Score

Regular use of a no-annual-fee card can help businesses maintain a healthy credit utilization ratio. This can improve a business’s credit score over time, making it easier to secure loans or other financing in the future.In summary, choosing a business credit card with no annual fees not only reduces operational costs but also encourages businesses to use their cards more frequently, enhancing their financial agility and creditworthiness in the process.

Top Business Credit Cards with No Annual Fees

Finding the right business credit card can significantly influence your operational efficiency and bottom line. A card with no annual fees allows you to maximize your rewards without worrying about extra expenses. Here, we’ll explore some of the top business credit cards that come without annual fees, detailing their features, pros and cons, and insights from actual users.

Best Options for Business Credit Cards

The following table summarizes some of the best business credit cards that do not charge an annual fee. This comparison focuses on key features and rewards that can benefit small business owners.

| Card Name | Key Features | Pros | Cons |

|---|---|---|---|

| Chase Ink Business Cash® Card | 5% cash back on the first $25,000 spent in combined purchases at office supply stores and on internet, cable, and phone services | High cash back rate, no annual fee | Requires good to excellent credit |

| American Express Blue Business Cash™ Card | 2% cash back on the first $50,000 spent each year, then 1%, and no annual fee | Flexible payment options, great cash back rewards | Foreign transaction fees apply |

| Bank of America® Business Advantage Cash Rewards Mastercard® | 3% cash back in the category of your choice, 2% at grocery stores, 1% on all other purchases | Customizable rewards categories | Annual cash back limit on 3% and 2% categories |

| Capital One Spark Cash Select for Business | 1.5% cash back on every purchase, no annual fee | Unlimited cash back, easy redemption | Limited bonus offerings compared to competitors |

User experiences can provide valuable insights into the practicality of these business credit cards.

“With the Chase Ink Business Cash® Card, I’ve been able to earn significant cash back on my office supplies, which really helps offset my monthly expenses!”

Mark T., small business owner.

“The American Express Blue Business Cash™ Card suits my business well since I often spend more than the threshold for the 2% cash back. It’s a reliable card for daily expenses.”

Sarah L., entrepreneur.

“The Capital One Spark Cash Select has been a straightforward rewards card; I appreciate how easy it is to earn and redeem cash back.”

Jason R., freelance consultant.

These testimonials reflect the satisfaction of users with the respective offerings of each card. The pros and cons highlighted can help business owners decide which card aligns best with their spending habits and financial goals.

How to Choose the Right Business Credit Card

Choosing the right business credit card can significantly impact your company’s financial health and operational efficiency. With numerous options available, it’s essential to tailor your selection based on the specific needs and spending habits of your business. A well-informed choice can lead to substantial rewards, lower costs, and enhanced cash flow management.Evaluating different business credit card options involves careful consideration of several key factors.

To streamline your decision-making process, a checklist can be extremely useful. Here’s a breakdown of what to look for when selecting a business credit card.

Evaluation Checklist for Business Credit Cards

When reviewing potential business credit cards, consider the following factors to ensure you choose the best fit for your needs:

- Rewards and Incentives: Assess the rewards structure, such as cashback on purchases or travel points, and ensure it aligns with your typical spending.

- Interest Rates: Compare the annual percentage rates (APRs) to find a card with competitive rates, especially if you anticipate carrying a balance.

- Credit Limit: Understand the credit limit offered and how it meets your business’s financial requirements.

- Additional Fees: Look for any hidden fees beyond the annual fee, including foreign transaction fees or late payment penalties.

- Customer Service: Evaluate the quality of customer support, as helpful service can be crucial in resolving urgent issues.

Understanding your business’s spending habits and needs is vital when selecting a card. Analyze your monthly expenditures to identify where you can maximize rewards. For instance, if your business frequently travels, a card offering travel rewards might be advantageous. Alternatively, if most expenses are on office supplies, look for cards that provide cashback on such purchases.

Potential Pitfalls to Avoid When Applying

While applying for a business credit card can be straightforward, several common pitfalls can derail your efforts or lead to unfavorable outcomes.

- Overlooking Terms and Conditions: Always read the fine print. Some cards may have promotional rates that increase significantly after an introductory period.

- Not Considering Long-term Needs: Choose a card that not only meets your immediate business needs but also supports growth as your business expands.

- Failing to Monitor Credit Score: Be aware of how your credit score affects your eligibility and interest rates. Regular monitoring can help you maintain and improve your score.

- Ignoring Renewal Terms: Understand the terms for card renewal, as some issuers may change rewards structures or fees upon renewal.

Choosing the right business credit card is not just about immediate benefits; it’s a strategic decision that can influence your business’s financial trajectory.

Additional Tips for Using Business Credit Cards

Source: cloudinary.com

Managing a business credit card effectively can be a game changer for your company. Not only does it streamline expenses, but it can also enhance cash flow and build your business credit. Here are some best practices to ensure you maximize the benefits of your business credit card while keeping your finances in check.

Best Practices for Managing Payments

Timely payment of your business credit card bills is crucial to maintaining a healthy financial profile. Here are some strategies to ensure you stay on top of your payments:

- Set Up Automatic Payments: Automate payments to avoid late fees and potential damage to your credit score. You can choose to pay the minimum amount or the total balance, depending on your cash flow.

- Track Payment Due Dates: Mark your calendar or set reminders to stay aware of when payments are due. This will help prevent missed payments and the associated penalties.

- Utilize Expense Tracking Software: Consider using financial tools that integrate with your credit card to track expenditures easily. This can help you stay organized and make timely payments without stress.

Maximizing Rewards and Benefits

Many business credit cards come with various rewards programs, cash back, and perks. To truly capitalize on these benefits, consider the following approaches:

- Choose the Right Card: Select a card that offers rewards aligned with your business spending habits, such as travel, office supplies, or dining out.

- Take Advantage of Bonus Categories: Many cards offer higher rewards for specific categories. Make sure you know your card’s bonus categories and prioritize spending in those areas.

- Redeem Rewards Strategically: Understand how your rewards can be redeemed for the best value. Some cards may offer better value for travel rather than cash back, for instance.

Monitoring Credit Utilization and Score Maintenance

Keeping an eye on your credit utilization ratio and credit score is vital for the long-term success of your business. Here’s how to stay proactive:

- Maintain a Low Utilization Ratio: Aim to keep your credit utilization below 30%. This means if you have a credit limit of $10,000, try to keep your balance below $3,000.

- Regularly Check Your Credit Report: Obtain your credit report periodically to ensure accuracy. Look for any discrepancies that could negatively impact your score.

- Pay Off Balances Monthly: Always strive to pay your full balance each month to avoid interest charges and maintain a good credit score.

Frequently Overlooked Considerations

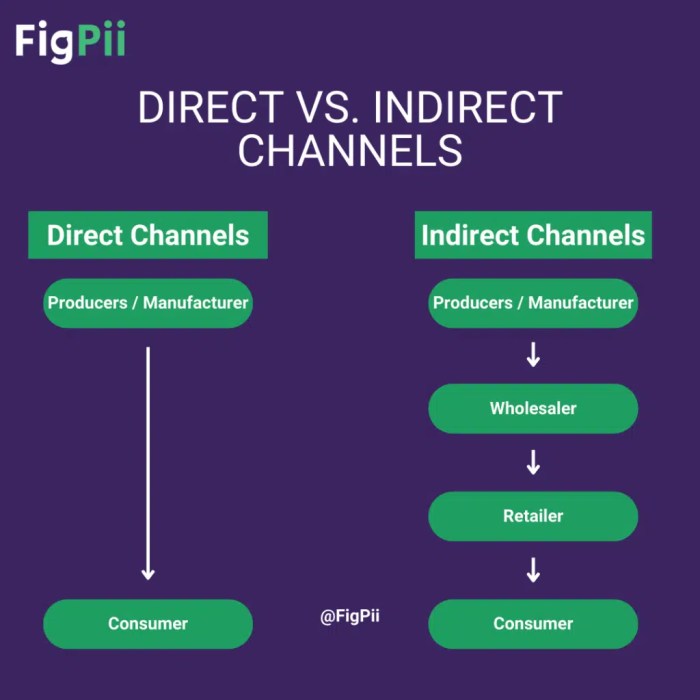

Source: figpii.com

Many individuals and businesses rush to apply for a business credit card without thoroughly reviewing the associated terms and conditions. While no annual fee cards come with various benefits, several hidden fees or conditions may not be immediately apparent. Understanding these elements can significantly influence your business’s financial health and ensure you make an informed decision when selecting a credit card.

Hidden Fees and Charges

Business credit cards can come with unexpected fees that could diminish the value of no annual fee offerings. It’s essential to be aware of these potential charges:

- Foreign Transaction Fees: Many cards impose a fee, typically around 3%, for purchases made outside the home country. This can add up if your business involves international dealings.

- Cash Advance Fees: Taking cash out from your credit card can result in hefty fees and higher interest rates, which often begin accruing immediately.

- Late Payment Fees: Missing a payment can incur significant penalties, further driving up your costs.

- Returned Payment Fees: If a payment bounces, expect additional charges that can vary by card issuer.

Understanding these fees is crucial as they can accumulate and impact your overall credit card costs.

Terms and Conditions to Know

Before applying for a business credit card, reviewing the fine print is vital to avoid surprises. Important terms to consider include:

- Interest Rates: The APR (Annual Percentage Rate) can vary widely. Cards may offer introductory rates that jump significantly after a promotional period.

- Credit Limit: Your credit limit can affect your business’s cash flow. Be aware of your limit and any potential penalties for exceeding it.

- Rewards Structure: Knowing how rewards are earned and redeemed can help you maximize benefits. Some cards may have categories with lower rewards rates.

Familiarizing yourself with these terms can help you utilize your card effectively and avoid financial pitfalls.

Impact of Credit Card Usage on Business Finances

The way you use your business credit card can have long-term implications for your business’s financial health. Here are key insights:

- Credit Utilization Ratio: Keeping your credit utilization below 30% is advisable for maintaining a good credit score. High usage can negatively impact your credit rating.

- Building Credit History: Regular, responsible use of your business credit card can help build a positive credit history, which is vital for obtaining loans or other credit facilities in the future.

- Cash Flow Management: Using your card strategically can help manage cash flow effectively. However, careless spending can lead to debt accumulation that may be hard to repay.

Being informed about how your credit card usage affects your finances will help you make better spending decisions and maintain a healthy financial profile.

Closing Summary

In conclusion, choosing the right business credit card can make a substantial difference in managing your company’s finances. The Best Business Credit Cards with No Annual Fees provide an excellent opportunity for small businesses to leverage rewards while avoiding unnecessary costs. By understanding the features, benefits, and potential pitfalls associated with these cards, entrepreneurs can confidently enhance their financial strategy and set their businesses up for lasting success.

Frequently Asked Questions

What are the typical eligibility requirements for business credit cards?

Eligibility usually requires a valid business license, a good credit score, and proof of business income.

Can I earn rewards with no annual fee business credit cards?

Yes, many no annual fee business credit cards offer rewards programs, including cashback and points for purchases.

How can I maximize benefits from business credit cards?

To maximize benefits, use your card for regular business expenses, pay off the balance in full each month, and track your rewards closely.

Are there any hidden fees associated with these cards?

While there are no annual fees, be aware of potential foreign transaction fees, late payment fees, and cash advance fees.

How does using a business credit card affect my personal credit score?

Using a business credit card responsibly can help improve your personal credit score, but missed payments may negatively impact it.

![Ufit:index [MLZ - Wiki]](https://money.narasi.tv/wp-content/uploads/2025/06/faa25d526aee0c35e409a2fb33531950-75x75.jpg)

![Ufit:index [MLZ - Wiki]](https://money.narasi.tv/wp-content/uploads/2025/06/faa25d526aee0c35e409a2fb33531950-120x86.jpg)