Capital Gains Tax Explained What Investors Should Know is a crucial topic for anyone navigating the investment landscape. Understanding how capital gains tax works can significantly impact your financial strategies and long-term wealth accumulation.

This tax applies to the profit made from selling assets like stocks, real estate, or other investments, and it’s essential for investors to grasp the calculation methods, current rates, and available exemptions. By delving into both short-term and long-term capital gains, investors can make informed decisions that optimize their returns while minimizing their tax liabilities.

Overview of Capital Gains Tax

Capital gains tax is a critical consideration for investors, as it directly impacts the profitability of their investments. This tax is levied on the profit earned from the sale of assets, such as stocks, real estate, and other investments. Understanding how capital gains tax works is essential for effective financial planning and maximizing returns.

Calculating capital gains tax involves determining the profit made from an investment by subtracting the asset’s original purchase price (also known as the basis) from its selling price. The resulting amount is classified as either long-term or short-term capital gain, which affects the tax rate applied. Long-term capital gains apply to assets held for more than one year, typically enjoying lower tax rates, while short-term gains, resulting from assets held for one year or less, are taxed at ordinary income rates.

Types of Capital Gains

Understanding the difference between short-term and long-term capital gains is crucial for tax planning. The classification hinges on the duration for which the asset is held before selling.

Short-term capital gains are realized when an investment is sold after being held for one year or less. These gains are taxed at the investor’s ordinary income tax rate, which can be significantly higher than the rates for long-term gains. In contrast, long-term capital gains arise from the sale of assets held for longer than one year. The tax rates for long-term gains are generally more favorable, often ranging from 0% to 20%, depending on the investor’s income level.

“Investors are encouraged to hold assets for longer periods to benefit from the lower long-term capital gains tax rates.”

To provide a clearer understanding of these two types of capital gains, consider the following points:

- Short-term Capital Gains: Taxed at the individual’s ordinary income tax rate, which can be as high as 37% based on income brackets.

- Long-term Capital Gains: Taxed at reduced rates; for example, a single filer in 2023 with taxable income below $44,625 may pay 0%, while those with income over $492,300 may pay 20%.

- Holding Period: The holding period starts the day after purchase and ends on the day of sale, affecting the tax implications significantly.

These distinctions highlight the importance of strategic investment planning and timing in order to minimize tax liabilities and enhance overall financial performance. Investors must be aware of how their actions can influence capital gains tax outcomes, as it plays a pivotal role in the net returns they ultimately receive from their investments.

Capital Gains Tax Rates

Understanding capital gains tax rates is essential for investors to effectively plan their financial strategies. These rates can significantly influence investment decisions and overall profitability. In various regions, the capital gains tax rates differ based on the duration an asset is held and the taxpayer’s income level.

Current Capital Gains Tax Rates

The capital gains tax rates vary across countries and can be grouped into short-term and long-term categories. Short-term capital gains, typically defined as profits from assets held for less than a year, are often taxed at the individual’s ordinary income tax rate. Conversely, long-term capital gains, from assets held for more than a year, are subjected to lower tax rates.

Here’s a brief overview of current rates in select regions:

- United States:

- Short-term: Taxed as ordinary income (10%

-37%) - Long-term: 0%, 15%, or 20% depending on income level

- Short-term: Taxed as ordinary income (10%

- United Kingdom:

- Short-term: Taxed as income

- Long-term: 10% for basic rate taxpayers, 20% for higher rate taxpayers

- Canada:

- Short-term: Taxed as ordinary income

- Long-term: 50% of the capital gain is included in taxable income

Impact of Income Levels on Tax Rates

Capital gains tax rates are heavily influenced by the individual’s income level. In many jurisdictions, the tax rates for long-term capital gains are designed to favor lower-income earners, providing them with a 0% tax rate in some cases. As the income level increases, the tax rate on long-term gains also escalates. For instance, in the United States, individuals with a taxable income under $41,675 may not pay any tax on long-term capital gains.

However, those with incomes exceeding $492,300 are taxed at the highest long-term capital gains rate of 20%. This tiered approach incentivizes investments for lower-income taxpayers while progressively taxing wealthier individuals more heavily.

“Understanding the interplay between income levels and capital gains tax rates can lead to more informed investing decisions.”

By grasping the nuances of capital gains tax rates, investors are better equipped to navigate the complexities of tax liabilities, ultimately maximizing their investment returns.

Exemptions and Deductions

Source: openclipart.org

Navigating capital gains tax can be complex, but understanding the various exemptions and deductions available is crucial for minimizing your tax liability. These provisions can significantly affect the amount of tax you owe when selling assets or investments. Here, we will explore the key exemptions and deductions that can help reduce your capital gains tax burden.

Available Exemptions for Capital Gains Tax

Certain exemptions can help you avoid paying capital gains tax altogether, particularly in specific scenarios. These exemptions often apply to long-term investments and specific types of assets.

- Primary Residence Exemption: If you sell your primary residence, you may qualify for an exclusion of up to $250,000 in capital gains for single filers and up to $500,000 for married couples filing jointly, provided you lived in the home for at least two of the last five years. This exemption is particularly beneficial for homeowners, allowing them to retain more of their profit.

- Investment in Opportunity Zones: Capital gains from investments in designated Opportunity Zones can be deferred or excluded, depending on the duration of the investment. This initiative incentivizes investment in economically distressed areas and can lead to substantial tax benefits.

- Like-Kind Exchange (1031 Exchange): A 1031 exchange allows you to defer capital gains tax on the sale of an investment property as long as you reinvest the proceeds into a similar property. This is a strategic option for real estate investors looking to upgrade or diversify their holdings without incurring immediate tax liabilities.

Tax Deductions to Reduce Capital Gains Tax Liability

In addition to exemptions, various tax deductions can decrease your overall capital gains tax liability. These deductions can arise from costs related to your investments and asset sales.

- Cost Basis Adjustments: Deductible expenses that can increase your cost basis include improvements made to an asset, which can ultimately lower your capital gains. Keeping thorough records of these expenses is essential for accurate reporting.

- Capital Losses: If you have investments that performed poorly, you can offset gains with losses. This strategy, known as tax-loss harvesting, allows you to sell losing investments to offset taxable gains, effectively reducing your overall capital gains tax.

- Investment-Related Expenses: Certain expenses directly related to the management or sale of your investments, such as brokerage fees and financial advisor fees, may be deductible, further reducing your taxable income.

Impact of Primary Residence Sales on Capital Gains Tax

Selling your primary residence can lead to significant tax advantages. The capital gains exclusion mentioned earlier is a key feature that benefits homeowners. To qualify, you must meet specific criteria related to ownership and use of the property.

The exclusion allows homeowners to keep a substantial portion of their profit, effectively encouraging home sales and promoting investment in real estate.

It’s important to note that if your capital gain exceeds the exclusion limit, the excess will be subject to capital gains tax. Additionally, if the property was used for rental purposes or if part of it was used for business, the exclusion may be limited. Proper documentation and understanding of your specific situation are essential when calculating potential tax liabilities from the sale of a home.

Reporting Capital Gains on Tax Returns

Reporting capital gains on your tax return is a crucial step in ensuring that you comply with tax regulations and accurately reflect your financial situation. Understanding how to report these gains can help you avoid potential penalties and make the most of any available deductions or exemptions.

The process of reporting capital gains involves several key steps, which vary slightly depending on the types of assets involved. Keeping meticulous records of your transactions is essential for accurate calculations and for substantiating your claims in the event of an audit. Below is a comprehensive step-by-step guide to reporting capital gains for different asset classes.

Step-by-Step Guide to Reporting Capital Gains

Accurate reporting of capital gains requires a methodical approach. Here’s a clear Artikel of how to report gains from various assets:

1. Identify Assets Sold

List all assets sold during the tax year. This includes stocks, real estate, and other investments where appreciation occurred.

2. Determine the Sale Price

For each asset, record the gross sale price. This is the amount you received from selling the asset before any expenses.

Example

If you sold a stock for $10,000, that’s your sale price.

3. Calculate the Cost Basis

The cost basis is your original investment in the asset plus any additional costs incurred (like commissions or improvements for real estate).

If you bought the stock for $5,000 and paid a $50 commission, your cost basis is $5,050.

4. Compute the Capital Gain

Subtract the cost basis from the sale price to determine the capital gain.

Formula

Capital Gain = Sale Price – Cost Basis

Using the previous example

$10,000 (sale price)

$5,050 (cost basis) = $4,950 (capital gain).

5. Classify the Gain

Determine whether the gain is short-term (held for one year or less) or long-term (held for more than one year). This classification affects the tax rate applied to your gain.

6. Report on Tax Forms

Use the appropriate tax forms to report your capital gains. For individual taxpayers, this is typically done on Schedule D (Capital Gains and Losses) and Form 8949.

Schedule D summarizes your overall capital gains and losses, while Form 8949 details each transaction.

7. Transfer Totals to Your 1040 Form

Finally, carry over your total gains or losses from Schedule D to your Form 1040, where your overall income will be calculated.

Maintaining accurate records is vital for this process. Keep track of purchase receipts, sale confirmations, and any associated costs that affect your cost basis. The IRS requires you to support your claims with documentation, and a well-organized record-keeping system can save you time and stress, especially during tax season.

Accurate records help ensure correct calculations and provide essential evidence in case of audits.

Strategies for Minimizing Capital Gains Tax

Source: amazonaws.com

Understanding how to minimize capital gains tax is essential for investors looking to optimize their returns. By employing certain strategies, investors can reduce their tax liabilities, ultimately preserving more of their profits. This section will explore various investment strategies, tax-loss harvesting, and the use of tax-advantaged accounts to lessen capital gains tax exposure.

Investment Strategies to Minimize Capital Gains Tax

Investors can adopt specific strategies to minimize their capital gains tax liabilities. These approaches primarily focus on the timing of asset sales and the selection of investment types. Here are some strategies that can be effective:

- Long-Term Holding: Holding investments for more than a year qualifies for lower long-term capital gains tax rates. This can significantly reduce the tax burden compared to short-term capital gains rates, which are taxed as ordinary income.

- Asset Location: Placing investments in the most tax-efficient accounts can help reduce capital gains taxes. For instance, holding high-growth assets in tax-advantaged accounts like IRAs or 401(k)s can shield them from capital gains tax until withdrawals are made.

- Utilizing Qualified Opportunity Zones: Investing in qualified opportunity zones can defer and potentially reduce capital gains taxes. Gains from investments in these areas can be excluded from taxes if held long enough.

Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling securities at a loss to offset gains in other investments. This method can significantly reduce an investor’s overall tax burden. Here are the benefits and the process involved in tax-loss harvesting:

- Offsetting Gains: Selling a losing investment can offset the taxes owed on gains realized from other investments, which can lead to substantial tax savings.

- Resetting Cost Basis: By selling at a loss, investors can reset their cost basis and potentially increase future gains while minimizing tax impact.

- Continuous Strategy: Tax-loss harvesting is not limited to year-end; investors can employ this strategy throughout the year whenever market conditions present opportunities.

“Tax-loss harvesting can be an effective way to manage tax liabilities, especially in volatile markets where asset prices fluctuate.”

Role of Tax-Advantaged Accounts

Tax-advantaged accounts play a crucial role in minimizing capital gains tax liability. These accounts provide various benefits that can help investors reduce taxes on their investment income. Some key points regarding these accounts include:

- Tax Deferral: Investments in accounts such as traditional IRAs or 401(k)s grow tax-deferred, meaning taxes are only paid upon withdrawal, which can often be at a lower rate.

- Tax-Free Growth: Roth IRAs allow for tax-free growth and tax-free withdrawals in retirement, making them a powerful tool for minimizing capital gains tax on investments.

- Flexible Contributions: Many tax-advantaged accounts offer flexibility in contributions, allowing investors to manage their tax liabilities effectively through strategic contributions and withdrawals.

“Leveraging tax-advantaged accounts is a smart way to boost investment returns while minimizing capital gains taxes.”

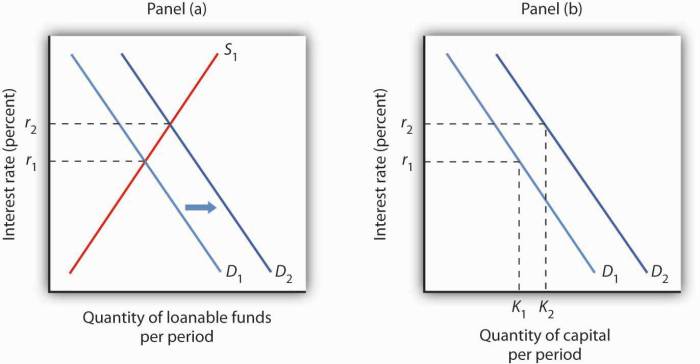

Capital Gains Tax Impact on Investment Decisions

The capital gains tax significantly influences how investors approach their strategies and decision-making processes. Understanding how this tax operates can shape an investor’s portfolio and influence the timing of asset sales. This section explores the intricate relationship between capital gains tax and investment choices, as well as the psychological factors that come into play.

Influence on Investment Strategies

Capital gains tax can dictate investment strategies by affecting when and how investors buy or sell assets. Investors often consider tax implications in their decision-making process, which can lead to distinct approaches, such as:

- Holding Investments Longer: Many investors opt to hold onto their securities for over a year to benefit from preferential long-term capital gains rates. This can lead to more stability in the market as investors are less likely to engage in frequent buying and selling.

- Tax-Loss Harvesting: This strategy involves selling underperforming assets to offset gains elsewhere in a portfolio, thereby reducing tax liability. Investors actively seeking to minimize their taxes often employ this tactic.

- Asset Allocation Adjustments: Capital gains tax considerations may lead investors to reevaluate their asset allocations, favoring tax-efficient investments like index funds or tax-exempt municipal bonds to minimize tax burdens.

Understanding these strategies can empower investor decision-making, allowing for more intentional portfolio management that aligns with their financial goals.

Psychological Effects on Investor Behavior

The impact of capital gains tax extends beyond financial considerations and delves into the psychological realm. The awareness of impending tax liabilities can lead to various behavioral responses among investors, such as:

- Loss Aversion: Investors may be hesitant to sell winning investments due to the fear of capital gains taxes. This aversion can lead them to hold onto assets longer than they should, potentially missing out on better investment opportunities.

- Overreaction to Market Changes: The potential tax implications can cause investors to overreact to market fluctuations. They may sell off assets prematurely to avoid perceived gains, which can lead to regret and second-guessing their decisions.

- Tax Timing Decisions: Investors often strategize around their tax situation, choosing to sell an asset in a year where they anticipate lower income or capital gains, which can distort their natural investment timing.

These psychological factors can dramatically affect market dynamics and investor behavior, leading to decisions that may not align with an investor’s fundamental objectives.

Case Studies of Managing Capital Gains Tax Impacts

Real-world examples illustrate how savvy investors have navigated the challenges of capital gains tax effectively. One notable case is:

- The Case of a Long-Term Holder: An investor named Alex purchased shares in a tech company at a low price and held onto them for several years. By doing so, Alex benefited from long-term capital gains tax rates, which allowed him to keep a larger portion of his returns compared to if he had sold the shares sooner and faced higher short-term rates. Alex’s strategy exemplifies how understanding tax implications can enhance long-term wealth accumulation.

In a contrasting scenario:

- Tax-Loss Harvesting Success: An investor, Jamie, faced a dip in the real estate market and saw a significant drop in the value of her rental properties. Instead of holding onto the losses, she strategically sold some underperforming assets to realize losses, which offset her taxable gains from other investments. This maneuver not only minimized her liability but also positioned her portfolio for future growth when the market rebounded.

These cases highlight the importance of informed decision-making in investment planning, showcasing how capital gains tax can be managed effectively through strategic choices.

Future of Capital Gains Tax Legislation

Source: wikitravel.org

As the landscape of tax legislation continues to evolve, potential changes to capital gains tax laws remain a hot topic among investors. Understanding these possible changes can significantly affect investment strategies and overall financial planning. This section delves into the anticipated shifts in capital gains tax legislation and their implications for investors.

Possible Changes in Capital Gains Tax Legislation

Recent discussions among policymakers have suggested a range of potential changes to capital gains tax legislation. These changes could affect tax rates, exemptions, and reporting requirements. Investors should pay attention to these developments as they could influence investment decisions and the timing of asset sales.

- Increased Tax Rates: Proposals have been made to increase capital gains tax rates for high-income earners. This could mean that individuals making above a certain income threshold may face a higher tax burden on their investment profits.

- Shorter Holding Periods: Some lawmakers are considering reducing the holding period required to qualify for long-term capital gains tax rates. Currently, assets held for more than one year benefit from lower tax rates, but changes could shorten this timeframe.

- Taxation of Unrealized Gains: There has been discussion around taxing unrealized gains, meaning investors could face taxes on their investments even if they have not sold them. This concept, however, remains controversial and is still being debated.

Implications for Investors

Changes in capital gains tax legislation can have significant implications for how investors approach their portfolios. Investors need to adapt their strategies based on possible new regulations.

- Timing of Sales: If tax rates are set to increase, investors may consider selling assets sooner to take advantage of the current lower rates. Conversely, if rates are expected to decrease, waiting to sell could be more beneficial.

- Portfolio Management: Investors might need to reevaluate their investment strategies, especially with regard to asset allocation and diversification. Understanding how capital gains taxes affect different asset classes can inform better decision-making.

- Utilization of Deductions: If exemptions or deductions are modified, investors may need to take a more proactive approach in tax planning to maximize potential benefits and minimize liabilities.

Historical Trends in Capital Gains Tax Laws

Analyzing historical trends in capital gains tax laws provides insight into future developments. Historically, capital gains tax rates have fluctuated based on political climates and economic needs.

“Tax policy often reflects the prevailing economic conditions and societal values, which can lead to shifts in capital gains tax legislation.”

- 1986 Tax Reform Act: One of the most significant changes occurred with the Tax Reform Act of 1986, which lowered capital gains tax rates and aimed to simplify the tax code.

- Bush Tax Cuts: In the early 2000s, the Bush tax cuts reduced the capital gains tax rate to 15%, which encouraged investment and economic growth during recovery phases.

- Recent Trends: In the years following the 2008 financial crisis, discussions about increasing capital gains tax rates gained traction, especially as income inequality became a focal point of political discourse.

Investors who stay informed about potential legislative changes and historical trends will be better equipped to navigate the complexities of capital gains taxes and make strategic financial decisions.

Final Summary

In summary, effectively managing capital gains tax is an integral part of investment strategy that can lead to substantial financial benefits. As we’ve discussed, being aware of tax rates, potential exemptions, and effective reporting practices can empower investors to take control of their investment journey.

By employing smart strategies like tax-loss harvesting and keeping abreast of legislative changes, investors can navigate the complexities of capital gains tax with confidence, ultimately enhancing their investment outcomes.

FAQ Summary

What is capital gains tax?

Capital gains tax is a tax on the profit made from selling an asset, such as stocks or real estate.

How is capital gains tax calculated?

It is calculated by subtracting the original purchase price from the selling price of the asset.

What are short-term and long-term capital gains?

Short-term capital gains apply to assets held for one year or less, while long-term gains apply to assets held for more than one year.

Are there any exemptions for capital gains tax?

Yes, exemptions can include primary residence sales and certain retirement account transactions.

How can I minimize my capital gains tax liability?

Investors can minimize liability through strategies like tax-loss harvesting and utilizing tax-advantaged accounts.

Do capital gains tax rates vary by location?

Yes, capital gains tax rates can differ significantly based on the country or region where you reside.

What records should I keep for capital gains tax purposes?

It’s important to keep detailed records of purchase prices, sale prices, and any related expenses to accurately calculate capital gains.

![Best RV Portable Waste Tank [2020] | Top Motorhome Reviews](https://money.narasi.tv/wp-content/uploads/2025/06/BestPicks-350x250.png)