When it comes to planning for retirement, understanding the different types of Individual Retirement Accounts (IRAs) is essential. Comparing IRA Roth IRA and SEP IRA Which One is Best brings to light the unique benefits and limitations of each option, helping you make an informed choice based on your financial situation and future goals. Whether you’re a young professional just starting out or a self-employed individual looking to maximize your retirement savings, knowing the ins and outs of these accounts can make all the difference.

This overview will delve into the features of Traditional IRAs, Roth IRAs, and SEP IRAs, examining their tax implications, contribution limits, withdrawal rules, and suitability for various individuals. By the end, you’ll have a clearer picture of which IRA might serve your retirement needs best.

Overview of IRA Types

Understanding the different types of Individual Retirement Accounts (IRAs) is crucial for effective retirement planning. Traditional IRAs, Roth IRAs, and SEP IRAs serve distinct purposes and offer various benefits, making them suitable for different financial situations and goals. This overview will highlight their basic functions, compare their features, and provide historical context for each type.The Traditional IRA is designed to encourage individuals to save for retirement while offering tax advantages.

Contributions to a Traditional IRA may be tax-deductible, and taxes are paid upon withdrawal during retirement. In contrast, the Roth IRA allows for contributions made with after-tax income, meaning qualified withdrawals in retirement are tax-free. The SEP IRA is tailored for self-employed individuals and small business owners, allowing for higher contribution limits than Traditional and Roth IRAs.

Comparison of Key Features

When choosing the best IRA type, it’s important to compare their key features, including tax treatment, contribution limits, and eligibility requirements. Below is a table summarizing these aspects to provide clarity:

| IRA Type | Tax Treatment | Contribution Limits (2023) | Eligibility Requirements |

|---|---|---|---|

| Traditional IRA | Tax-deferred until withdrawal | $6,500 (or $7,500 if age 50+) | Anyone with earned income; deductions may phase out at higher incomes |

| Roth IRA | Tax-free withdrawals in retirement | $6,500 (or $7,500 if age 50+) | Income limits apply; must have earned income |

| SEP IRA | Tax-deferred until withdrawal | Up to 25% of compensation or $66,000 (whichever is less) | Self-employed individuals or small business owners |

The historical context of each IRA type reflects the evolving landscape of retirement savings. Traditional IRAs were established in 1974 with the Employee Retirement Income Security Act (ERISA), aiming to provide a tax-advantaged savings option for employees. The Roth IRA was introduced in 1997, catering to individuals seeking tax-free income in retirement, appealing particularly to younger savers who expect to be in higher tax brackets later.

The SEP IRA emerged in 1978 to support self-employed individuals and business owners, acknowledging their unique retirement savings needs by allowing higher contribution limits.

“The right IRA choice profoundly impacts your retirement savings trajectory.”

Tax Implications

Understanding the tax implications associated with different types of Individual Retirement Accounts (IRAs) is essential for making informed financial decisions. Each IRA type comes with its unique tax benefits and responsibilities, influencing how you save for retirement and the overall growth of your investments.Tax benefits play a significant role in determining which IRA might suit your financial goals best. Here’s a breakdown of the tax implications for Traditional IRAs, Roth IRAs, and SEP IRAs, including how withdrawals are taxed and the penalties associated with early withdrawals.

Tax Benefits and Withdrawals

Each type of IRA has distinct tax advantages and disadvantages, which can affect your retirement strategy. Understanding these differences can help you optimize your retirement savings.

| IRA Type | Tax Advantages | Tax Disadvantages | Withdrawal Taxation |

|---|---|---|---|

| Traditional IRA |

|

|

|

| Roth IRA |

|

|

|

| SEP IRA |

|

|

|

“Understanding the tax implications of each IRA type helps in making strategic decisions about retirement savings.”

The tax implications associated with IRAs significantly influence not only your current financial situation but also your long-term retirement plans. Each IRA type has its unique benefits and challenges; thus, evaluating these factors relative to your financial goals is crucial.

Contribution Limits and Eligibility

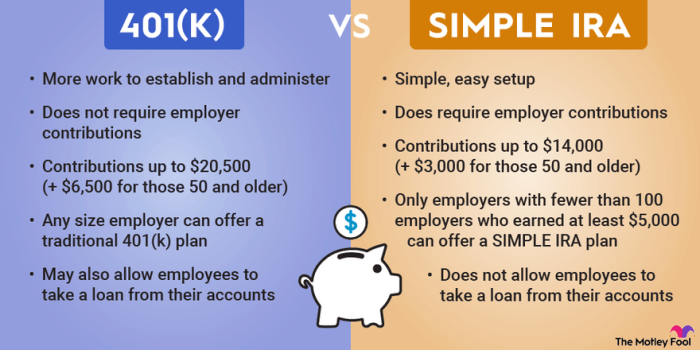

Source: foolcdn.com

When considering the best retirement savings option, understanding the contribution limits and eligibility criteria for each type of IRA is essential. Each account type has distinct rules regarding how much you can contribute annually and who is eligible based on income. This section will break down those differences, helping you make an informed decision based on your financial situation and retirement goals.The annual contribution limits vary among Traditional IRAs, Roth IRAs, and SEP IRAs, along with specific eligibility requirements based on your income.

Knowing these details can ensure you maximize your savings potential while complying with IRS regulations.

Contribution Limits

Each IRA type has specific annual contribution limits which depend on your age. For 2023, the contribution limits are as follows:

- Traditional IRA:

- Under age 50: $6,500

- Age 50 and older: $7,500 (including a $1,000 catch-up contribution)

- Roth IRA:

- Under age 50: $6,500

- Age 50 and older: $7,500 (including a $1,000 catch-up contribution)

- SEP IRA:

- Up to 25% of compensation or $66,000 (whichever is less) for 2023.

Eligibility Criteria

Eligibility to contribute varies among the types of IRAs, particularly with respect to income levels. Here’s a summary of the requirements:

- Traditional IRA:

- Anyone with earned income can contribute, but tax deductibility may be limited based on income and participation in an employer-sponsored plan.

- Roth IRA:

- Eligibility is phased out at higher income levels. For 2023, single filers with modified adjusted gross income (MAGI) above $138,000 and married couples filing jointly over $218,000 may have reduced contributions.

- SEP IRA:

- Self-employed individuals and small business owners can establish SEP IRAs with no income limit. Contributions are based on income, and the business must have a consistent history of contributions to be eligible.

The specific contribution limits and eligibility criteria for each IRA type can significantly influence your retirement strategy.

Withdrawal Rules

Understanding the withdrawal rules associated with different types of IRAs is crucial for making informed financial decisions. Each IRA type has its own set of regulations that dictate when and how you can access your funds without incurring penalties. This section explores the withdrawal rules for Traditional IRAs, Roth IRAs, and SEP IRAs, allowing you to navigate your retirement planning with clarity.

Traditional IRA Withdrawal Rules

Traditional IRAs come with specific age restrictions and potential penalties that you should be aware of. Withdrawals from a Traditional IRA are generally allowed starting at age 59½ without incurring a 10% early withdrawal penalty. However, withdrawals made before this age may be subject to this penalty unless certain exceptions apply, such as disability or substantial medical expenses. It’s essential to note that you must begin taking Required Minimum Distributions (RMDs) by age 73, which are mandatory withdrawals based on your life expectancy.

“Any amount withdrawn from a Traditional IRA will be subject to income tax at your current tax rate.”

Roth IRA Qualified Distributions

Roth IRAs offer more flexibility with withdrawals compared to Traditional IRAs. Contributions to a Roth IRA can be withdrawn at any time without penalties or taxes, since they were made with after-tax dollars. However, to withdraw earnings tax-free, you must meet specific conditions known as qualified distributions. This generally requires the account to be open for at least five years and the account holder to be at least 59½ years old, or to meet certain other criteria such as being permanently disabled or using the funds for a first-time home purchase.

“Qualified distributions from a Roth IRA allow you to access your earnings without incurring taxes, provided you meet the requirements.”

SEP IRA Withdrawal Scenarios

SEP IRAs, designed primarily for self-employed individuals or small business owners, have their unique withdrawal guidelines. Similar to Traditional IRAs, withdrawals from a SEP IRA are also subject to the same age restrictions and penalties. However, it’s important to consider different scenarios when thinking about withdrawals:

1. Early Withdrawal Penalty

If you withdraw funds before age 59½, you will face a 10% penalty on the amount withdrawn, as well as income tax.

2. Disability or Medical Expenses

If you become disabled or incur significant medical expenses, you may be able to withdraw funds without incurring penalties.

3. Business Use

As a self-employed individual, you might consider taking a withdrawal to fund business expenses, but it is crucial to understand the tax implications and penalties that may apply.

“Withdrawal strategies should be carefully planned, considering both the timing and the purpose of the withdrawal.”

Suitability for Different Individuals

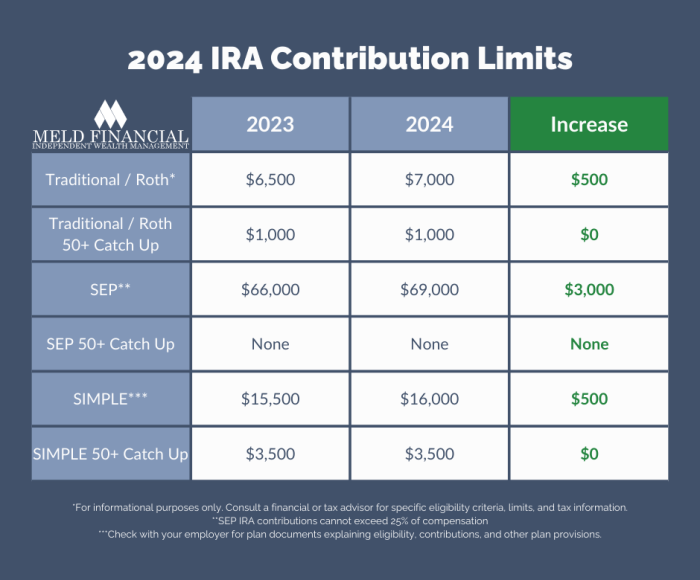

Source: meldfinancial.com

When selecting an IRA, understanding which type aligns best with your personal circumstances and financial goals is crucial. Different individuals have unique needs based on their career paths, income levels, and retirement aspirations. This section will explore how young professionals and self-employed individuals can leverage various IRA options to optimize their retirement savings.Young professionals often prioritize growth and flexibility in their investment choices.

A Roth IRA may be particularly appealing due to its tax-free growth potential and the ability to withdraw contributions without penalty. As they might be at a lower income level early in their careers, contributing to a Roth IRA allows them to lock in their tax rate while they are still in a relatively low tax bracket. In contrast, self-employed individuals face different challenges, such as variable income and the need for larger contribution limits.

A SEP IRA provides a robust solution, allowing for substantial contributions that can significantly reduce taxable income and facilitate larger retirement savings.

Retirement Goals and IRA Selection

Retirement goals play a significant role in determining the most suitable IRA type. Different scenarios can vary substantially based on individual aspirations, income levels, and employment types. Here’s a summary table that illustrates different life situations along with the recommended IRA type for each:

| Life Scenario | Recommended IRA Type | Reasoning |

|---|---|---|

| Young Professional starting a career | Roth IRA | Tax-free growth and flexibility in withdrawals |

| Self-employed individual with variable income | SEP IRA | Higher contribution limits and tax deductions |

| Mid-career employee looking to maximize savings | Traditional IRA | Tax deductions on contributions to lower taxable income |

| Individual nearing retirement with high income | Traditional IRA or Roth IRA (if eligible) | Tax strategy based on current vs. expected retirement income |

“Choosing the right IRA can significantly impact your financial future. Tailoring your selection to fit your unique circumstances is essential for successful retirement planning.”

Investment Options

Source: wixstatic.com

When it comes to choosing the right IRA, the variety of investment options available can significantly impact your long-term financial growth. Each type of IRA offers unique investment vehicles and levels of flexibility, allowing individuals to tailor their retirement accounts to suit their financial goals and risk tolerance. Understanding these differences is essential for making the most of your retirement savings.The investment flexibility varies among Traditional, Roth, and SEP IRAs, each providing diverse avenues for asset allocation.

With proper management, these accounts can grow substantially over time, depending on the investment choices you make. Below is a detailed look at the common investment vehicles available in each type of IRA.

Investment Vehicles for Each IRA Type

The investment options available within each IRA can cater to different strategies and preferences. It’s essential to be aware of these choices to align them with your retirement planning.

- Traditional IRA:

The Traditional IRA allows a variety of investment options, making it a versatile choice for many investors.

Common vehicles include:- Stocks

- Bonds

- Mutual Funds

- Exchange-Traded Funds (ETFs)

- Real Estate Investment Trusts (REITs)

- Certificates of Deposit (CDs)

- Roth IRA: Similar to the Traditional IRA, the Roth IRA offers a range of investment opportunities, but it also provides the added advantage of tax-free withdrawals on qualified distributions. Investment options include:

- Stocks

- Bonds

- Mutual Funds

- ETFs

- REITs

- Commodities (like gold or silver)

- SEP IRA: The SEP IRA is primarily designed for self-employed individuals and small business owners. It also has a wide selection of investments, similar to the Traditional and Roth IRAs, such as:

- Stocks

- Bonds

- Mutual Funds

- ETFs

- REITs

- Investment-grade Corporate Bonds

“Choosing the right investment options within your IRA can significantly influence your retirement savings growth.”

The range of investment choices in each IRA type not only caters to individual preferences but also enhances the potential for wealth accumulation. Tailoring your investment strategy based on your specific goals and the IRA type can help pave the way for a successful retirement.

Common Misconceptions

Many individuals interested in retirement savings often harbor misconceptions about the various types of Individual Retirement Accounts (IRAs). These misunderstandings can lead to suboptimal financial decisions, affecting both short-term savings and long-term financial health. It’s crucial to clarify these myths and present the facts to empower individuals and small business owners in their financial planning.Understanding the nuances between Traditional IRAs, Roth IRAs, and SEP IRAs can dispel common myths that may mislead potential investors.

By highlighting these misconceptions and providing factual information, individuals can make more informed choices when selecting the best retirement savings option for their needs.

Misconceptions about Traditional and Roth IRAs

Several myths surround Traditional and Roth IRAs, particularly concerning tax implications and eligibility criteria.

- Myth 1: Contributions to a Traditional IRA are tax-free.

Fact: While contributions may be tax-deductible, withdrawals during retirement are taxable.

- Myth 2: Roth IRAs are only for low-income earners.

Fact: Anyone can contribute to a Roth IRA as long as they meet the income limits—higher earners can still utilize a backdoor Roth IRA strategy.

- Myth 3: You can only withdraw from a Roth IRA after age 59½.

Fact: Contributions to a Roth IRA can be withdrawn at any time, tax-free and penalty-free.

Understanding these misconceptions is vital to ensure individuals do not miss out on the benefits each IRA type offers.

Myths Surrounding SEP IRAs for Small Business Owners

Small business owners often face their own set of misconceptions regarding SEP IRAs, which can hinder their ability to save effectively for retirement.

- Myth 1: SEP IRAs are only available for self-employed individuals.

Fact: SEP IRAs can also be established by small businesses, including partnerships and corporations, to benefit employees.

- Myth 2: Contributions are fixed and not flexible.

Fact: Contributions to a SEP IRA can vary yearly, allowing employers to adjust based on business performance.

- Myth 3: You cannot have a SEP IRA if you have a Traditional or Roth IRA.

Fact: Individuals can have multiple types of IRAs, as long as they adhere to contribution limits.

Addressing these misconceptions can empower small business owners to leverage SEP IRAs effectively for retirement savings.

Myths vs. Facts Summary

To further clarify the common misconceptions surrounding IRAs, here’s a concise summary highlighting the myths versus the facts:

| Myth | Fact |

|---|---|

| Contributions to Traditional IRAs are always tax-free. | Contributions may be tax-deductible, but withdrawals are taxed. |

| Roth IRAs are only for low-income earners. | Higher earners can also contribute through a backdoor Roth strategy. |

| You can only withdraw from a Roth IRA after age 59½. | Contributions can be withdrawn anytime, tax-free. |

| SEP IRAs are only for self-employed individuals. | Small businesses can also establish SEP IRAs for employees. |

| Contributions to SEP IRAs are fixed. | Contributions can vary depending on business performance. |

| You cannot have a SEP IRA if you have other IRAs. | You can have multiple IRAs with adherence to contribution limits. |

Final Review

In summary, navigating the world of IRAs can be complex, but understanding the distinctions between Traditional, Roth, and SEP IRAs is crucial for effective retirement planning. As we’ve discussed, each type of IRA has its own advantages and is tailored to different financial situations and goals. By evaluating your unique circumstances and preferences, you can select the IRA that aligns with your aspirations for a secure financial future.

Question Bank

What is the main difference between Traditional and Roth IRAs?

The primary difference lies in how and when you pay taxes: Traditional IRAs offer tax deductions on contributions but tax withdrawals, while Roth IRAs tax contributions upfront but allow tax-free withdrawals in retirement.

Can I have multiple IRA accounts?

Yes, individuals can have multiple IRA accounts of different types, but the total contributions must not exceed the IRS limits for each account type.

Is there an age limit for contributing to a Roth IRA?

No, there is no age limit for contributing to a Roth IRA as long as you have earned income and meet the income eligibility requirements.

What happens if I withdraw from my IRA early?

Early withdrawals from Traditional and Roth IRAs may incur penalties and taxes, depending on the circumstances, but Roth IRA contributions can be withdrawn penalty-free at any time.

Are SEP IRAs only for self-employed individuals?

While SEP IRAs are primarily designed for self-employed individuals and small business owners, they can also be used by any employer wishing to provide retirement benefits to their employees.