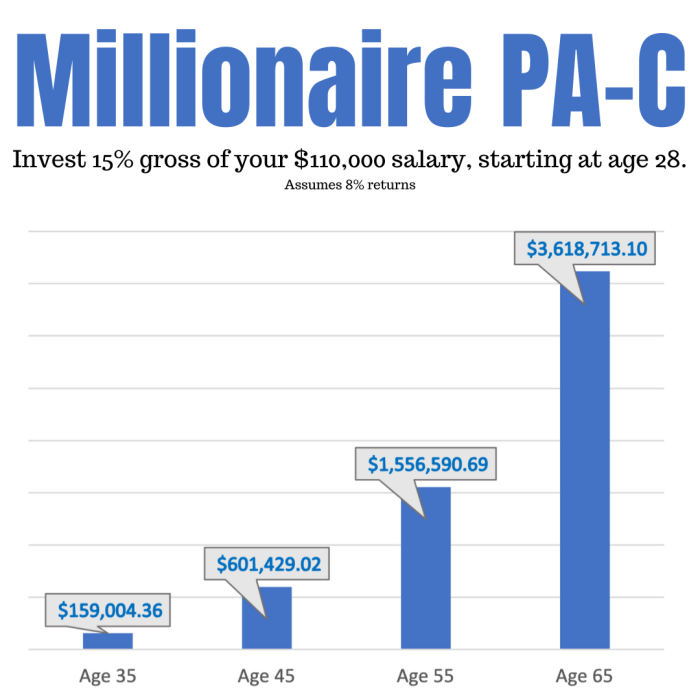

Understanding How Compound Interest Can Make You a Millionaire opens up a world of financial possibilities. Compound interest is not just a financial concept; it’s a powerful tool that can transform small investments into substantial wealth over time. By reinvesting earnings, you can leverage the time factor to maximize your returns, setting the stage for financial independence.

As we dive deeper into this topic, we will explore the principles of compound interest, the importance of time, and practical investment strategies that leverage this concept. With real-life examples and common misconceptions addressed, you’ll gain a comprehensive view of how starting early and making consistent contributions can lead to millionaire status.

The Concept of Compound Interest

Source: howdoyougetrichonline.com

Compound interest is a fundamental concept in finance that plays a vital role in wealth accumulation. Unlike simple interest, which is calculated solely on the principal amount, compound interest takes into account the interest that accumulates on both the initial principal and the interest that has already been added. This means that with compound interest, your investment can grow at a faster rate over time, as each interest payment contributes to the overall amount that earns interest in the future.The formula for calculating compound interest is given by:

A = P (1 + r/n)^(nt)

Where:

- A = the amount of money accumulated after n years, including interest.

- P = the principal amount (the initial amount of money).

- r = annual interest rate (decimal).

- n = number of times interest is compounded per year.

- t = the number of years the money is invested or borrowed.

To illustrate how compound interest works, consider the following examples across different time periods. These scenarios highlight the effect of time on investment growth due to compounding.

Examples of Compound Interest Over Time

The impact of compound interest can be best understood through time-based examples, showcasing different investment durations and interest rates. Here are a few scenarios:

1. Investment for 5 Years

Principal

$1,000

Annual Interest Rate

5%

Compounding Frequency

Annually Using the formula: A = 1000

- (1 + 0.05/1)^(1*5) = 1000

- (1.27628) ≈ $1,276.28

2. Investment for 10 Years

Principal

$1,000

Annual Interest Rate

5%

Compounding Frequency

Annually Using the formula: A = 1000

- (1 + 0.05/1)^(1*10) = 1000

- (1.62889) ≈ $1,628.89

3. Investment for 20 Years

Principal

$1,000

Annual Interest Rate

5%

Compounding Frequency

Annually Using the formula: A = 1000

- (1 + 0.05/1)^(1*20) = 1000

- (2.65330) ≈ $2,653.30

These examples clearly demonstrate that the longer the money is invested, the more pronounced the effects of compounding become. The difference between the amounts accumulated over just a few years can be significant, emphasizing the power of starting to invest early. The longer the time frame, the more the interest compounds, leading to exponential growth in the amount invested.

The Power of Time in Compound Interest

The impact of time on compound interest is profound and often underestimated. The longer your money has to grow, the more significant the results will be. Time acts as a catalyst in the compounding process, allowing your investment to not just grow, but to multiply exponentially. One way to grasp the importance of time in maximizing compound interest is through the “Rule of 72.” This simple formula helps investors estimate how long an investment will take to double given a fixed annual rate of return.

By dividing 72 by your expected annual return rate, you can quickly determine the number of years it will take for your initial investment to double. For example, if you expect a return of 6%, it will take approximately 12 years (72/6) for your investment to double.

Statistics on the Benefits of Starting Early

Starting to invest early can drastically change the trajectory of your financial future. The following statistics illustrate the significant impact of early investment on wealth accumulation:A 25-year-old who invests $5,000 annually at a 7% return will have around $1.2 million by age 65. In contrast, a 35-year-old starting with the same investment and return would end up with about $800,000 by the same age, illustrating a loss of nearly $400,000 simply due to a 10-year delay.

- According to a study by the National Bureau of Economic Research, investing just $1 more a day from age 20 to 30 can make a difference of over $1 million by retirement age, assuming a 7% return.

- The power of compounding reveals that if you invest $10,000 today and leave it to grow at an average annual return of 8%, in 30 years you could have over $100,000, emphasizing that time dramatically enhances investment growth.

“Time in the market beats timing the market.”

These figures underscore the critical role time plays in compound interest. By simply starting early, you leverage the full potential of compounding, allowing your investments to grow significantly over the years. The earlier you begin investing, the more you stand to gain, demonstrating that time is indeed a key ingredient in building wealth through compound interest.

Investment Strategies Utilizing Compound Interest

Investing wisely can significantly enhance your financial future, especially when leveraging the power of compound interest. Understanding different investment vehicles that utilize compound interest is essential for creating a diversified portfolio aimed at long-term wealth accumulation. Here, we will explore various investment options, their potential returns and risks, and provide a comprehensive guide to getting started with these investments.

Investment Vehicles that Utilize Compound Interest

There are several investment vehicles that effectively utilize compound interest to help grow your wealth over time. The following list highlights some of the most popular options:

- Savings Accounts: Traditional savings accounts offered by banks typically provide a modest interest rate compounded over time. They’re low-risk but may not yield high returns compared to other options.

- Bonds: When you purchase bonds, you’re effectively lending money to an issuer in exchange for periodic interest payments and the return of the bond’s face value at maturity. Bonds can provide steady returns, depending on the type and issuer, with varying levels of risk.

- Mutual Funds: These funds pool money from multiple investors to purchase a diversified portfolio of stocks and/or bonds. The returns can be volatile, but they offer the potential for higher gains over time through compound interest.

- Retirement Accounts (IRA, 401(k)): These accounts often include options for mutual funds and other investments, allowing your contributions to grow tax-deferred or tax-free, making them powerful tools for utilizing compound interest.

Understanding these investment vehicles is crucial as you consider where to allocate your funds for maximum compound growth. Each has its own profile of risk and return potential, important factors to weigh when planning your investments.

Comparison Table of Investment Options

When evaluating different investment options, it’s helpful to have a side-by-side comparison of potential returns and risks associated with each. The following table summarizes key aspects of various investment vehicles:

| Investment Type | Potential Return (%) | Risk Level |

|---|---|---|

| Savings Account | 0.01% – 1.5% | Very Low |

| Bonds | 2% – 6% | Low to Medium |

| Mutual Funds | 5% – 10%+ | Medium to High |

| Retirement Accounts | 6% – 12%+ | Medium |

This comparison helps illustrate the trade-offs between lower-risk, lower-return investments and those with higher potential gains but increased volatility.

Step-by-Step Guide to Setting Up an Account

Setting up an account to take advantage of compound interest is a straightforward process that can lay the groundwork for your investment strategy. Here’s a step-by-step guide to get started:

1. Research Financial Institutions

Start by researching banks, credit unions, or investment companies that offer accounts with compound interest options. Look for accounts with low fees and competitive interest rates.

2. Choose the Right Account Type

Depending on your investment goals, choose whether you want a savings account, bonds, mutual fund, or retirement account. Make sure it aligns with your risk tolerance and expected returns.

3. Gather Necessary Documents

Prepare the required documents, which typically include identification, Social Security number, and proof of address.

4. Complete the Application

Fill out the application either online or in person. Be sure to carefully read the terms and conditions associated with your chosen account.

5. Fund Your Account

Deposit an initial amount to fund your account. Many accounts have minimum deposit requirements, so be sure to meet those.

6. Set Up Automated Contributions

To maximize the benefits of compound interest, consider setting up regular automated contributions to your account. This habit can significantly enhance your investment growth over time.

7. Monitor Your Investments

Regularly review your account’s performance and make adjustments as necessary to ensure you are on track with your financial goals.

Following these steps will help you effectively open an account and start harnessing the power of compound interest to grow your wealth.

Real-life Examples of Millionaires Made Through Compound Interest

Many individuals have successfully harnessed the power of compound interest, leading them to accumulate substantial wealth over time. This phenomenon is not just a theoretical concept; it can become a reality for those who understand its mechanics and apply them diligently. The stories of these millionaires often highlight the importance of patience, strategic investment, and consistent saving, showcasing how small, regular contributions can snowball into significant financial growth.

Success Stories of Notable Millionaires

A few remarkable examples illustrate how compound interest can turn modest investments into millionaire portfolios. These individuals provide valuable insights into the strategies and habits that enabled their financial success.

“The key to financial freedom is understanding how to make your money work for you.” – Anonymous

1. Warren Buffett

Known as one of the most successful investors of all time, Warren Buffett started investing at a young age. With an initial investment of $1,200 in a textile business, he utilized compound interest by reinvesting his earnings. Over decades, his patience and disciplined investment strategy grew his net worth to over $100 billion. Buffett often emphasizes the importance of time in investment, stating that the longer you stay invested, the more your money compounds.

2. John Bogle

The founder of Vanguard Group, John Bogle, revolutionized investing by promoting low-cost index funds. By encouraging individuals to invest in diversified portfolios and holding them long-term, he exemplified the benefits of compound interest. His investment strategies have helped millions accumulate wealth, and Bogle himself amassed several million dollars through consistent contributions to index funds, demonstrating the power of passive investing.

3. Adele

The chart-topping singer has shared insights into her financial journey, where she began investing her earnings at a young age. By consistently reinvesting her earnings into various assets, including real estate and stocks, Adele has reportedly built a net worth of around $220 million. Her approach reflects diligence and a solid understanding of how compound interest can enhance wealth if managed wisely.

Chronological Growth of Investments

Understanding the timeline of these success stories helps illustrate the critical role that time and consistency play in building wealth through compound interest.

Warren Buffett

Age 11

Invested his first money in stocks.

Age 30

His investment company, Buffett Partnership Ltd., was established.

Age 65

Worth over $34 billion, primarily due to decades of compounding returns on his investments.

John Bogle

Age 25

Founded Vanguard Group in 1975, introducing low-cost investment options.

Age 50

Vanguard managed over $1 trillion in assets, a testament to the power of compound interest.

Age 89

Left a legacy that encouraged millions to invest wisely, resulting in substantial wealth accumulation.

Adele

Age 19

Released debut album “19,” beginning her journey in the music industry.

Age 25

Won multiple Grammy Awards, prompting increased earnings and investments.

Age 32

Her investments grew significantly, solidifying her status as a millionaire and demonstrating the benefits of long-term investing.

Habits and Strategies for Effective Compound Interest

The following strategies and habits have been crucial for these millionaires in maximizing the benefits of compound interest:

Regular Contributions

All three individuals made it a habit to regularly invest a portion of their income, understanding that consistency is key to wealth building.

Long-Term Perspective

They embraced a long-term approach, allowing their investments to compound over years rather than seeking immediate returns.

Diversification

They invested in a mix of assets, reducing risk and enhancing potential returns over time.

Education and Adaptation

Continuous learning about investment opportunities and adapting strategies accordingly played a pivotal role in their success.

In conclusion, the journey to becoming a millionaire through compound interest is a testament to the power of consistent effort, long-term planning, and educated investing. Each success story underscores the importance of starting early, being disciplined, and allowing money to work for you through the magic of compounding.

Common Misconceptions about Compound Interest

Many people have a vague understanding of compound interest, leading to several misconceptions that could hinder their investment decisions. While the concept sounds straightforward, the details often get lost in translation, creating myths that can misguide investors. It’s crucial to identify these misconceptions and clarify the realities to harness the true power of compound interest.Several mistakes often arise when individuals engage with compound interest.

Investors may underestimate its potential due to a lack of understanding or make poor decisions based on incorrect beliefs. By addressing these misconceptions, investors can make informed choices that enhance their wealth-building strategies.

Misconceptions Versus Facts

Below is a summary of common misconceptions about compound interest and the realities that challenge them. Understanding these discrepancies is vital for anyone looking to effectively utilize this financial principle.

| Misconception | Fact |

|---|---|

| Compound interest is just a fancy term for interest. | Compound interest refers to earning interest on both the initial principal and the accumulated interest from previous periods, which significantly increases the total returns over time. |

| You need to invest a large amount of money to benefit from compound interest. | Even small amounts can grow significantly over time due to the effect of compounding, particularly when invested early. |

| Compound interest works equally well for all financial products. | Not all investments compound in the same manner. Understanding how often interest compounds (annually, semi-annually, quarterly, etc.) is crucial to maximizing your returns. |

| Once you start investing, you don’t need to monitor it. | While compounding is powerful, regular monitoring and adjustment of your investments help ensure they remain aligned with your financial goals. |

| Compound interest is only beneficial for long-term investments. | While it is particularly effective over long periods, short-term investments can also benefit if the compounding frequency is high. |

The earlier you start investing, the more you benefit from the compounding effect, demonstrating that time is indeed a powerful ally in wealth accumulation.

Investors frequently overlook factors that directly impact the efficacy of compound interest, such as fees, the frequency of compounding, and the initial investment amount. Understanding these elements can lead to better financial decisions and greater wealth accumulation over time.

The Role of Consistency in Building Wealth

Building wealth through compound interest requires not just an understanding of the concept but also a commitment to consistent and regular contributions. The more frequently you invest and the longer your money remains invested, the greater the potential for your wealth to grow exponentially over time, thanks to the power of compounding. Regular contributions can significantly enhance the overall growth of your investments, allowing you to accumulate wealth more effectively.Consistency is crucial in maximizing the benefits of compound interest.

When you make regular contributions to your investment account, you not only increase the principal amount that earns interest but also take advantage of dollar-cost averaging. This means that when you invest on a regular schedule, you buy more shares when prices are low and fewer when prices are high, which can lead to lower average costs per share over time.

Methods for Establishing a Consistent Investment Habit

Creating a habit of consistent investing can be simple and effective. Here are several methods to help you establish this practice:

- Automatic Transfers: Set up automatic transfers from your checking account to your investment account. Most financial institutions offer the option to schedule these transfers, allowing you to invest a set amount regularly without needing to think about it.

- Budgeting for Investments: Include your investment contributions as a fixed line item in your monthly budget. Treating investment contributions as a non-negotiable expense can help ensure you prioritize them.

- Utilizing Employer-Sponsored Plans: If your employer offers a retirement savings plan, such as a 401(k), take full advantage of it. Contributing consistently, especially if your employer matches contributions, can significantly enhance your savings over time.

- Setting Clear Goals: Establish specific financial goals that motivate you to invest consistently. Whether it’s saving for retirement, a house, or a child’s education, having clear objectives can encourage regular contributions.

Establishing a monthly investment strategy emphasizes the significance of compound growth. Here’s a sample plan that illustrates how regular, consistent contributions can lead to significant wealth accumulation:

| Month | Contribution Amount | Total Investment | Estimated Value with 7% Annual Return |

|---|---|---|---|

| 1 | $500 | $500 | $535 |

| 2 | $500 | $1,000 | $1,080 |

| 3 | $500 | $1,500 | $1,648.50 |

| 4 | $500 | $2,000 | $2,229.00 |

| 5 | $500 | $2,500 | $2,823.43 |

| 6 | $500 | $3,000 | $3,432.02 |

| 12 (1 Year) | $500 | $6,000 | $6,394.39 |

In this example, consistently investing $500 each month can lead to an estimated total of $6,394.39 after one year, assuming a 7% annual return. The key takeaway here is that over time, even modest contributions can accumulate and grow significantly due to the effects of compound interest, particularly when they are made consistently. This illustrates the profound impact that regular investing can have on your journey toward wealth accumulation.

Tips for Maximizing Compound Interest

Maximizing compound interest is essential for anyone looking to build long-term wealth. By employing specific strategies, investors can enhance their growth potential and ensure their money works as effectively as possible for them. This section will explore actionable tips to increase effective interest rates, the significance of reinvesting earnings, and a checklist to optimize investment accounts for compound interest.

Strategies to Increase Effective Interest Rate

To maximize the power of compound interest, it’s crucial to identify ways to increase the effective interest rate on investments. Higher interest rates lead to more substantial growth over time. Consider the following strategies:

- Opt for high-yield savings accounts or investment vehicles that offer more competitive interest rates compared to traditional savings options. For instance, online banks often provide better rates than brick-and-mortar institutions.

- Look into certificates of deposit (CDs) or bonds that may offer fixed rates higher than standard savings accounts, ensuring that interest compounds over a specified term.

- Explore stock market investments, particularly index funds or ETFs that have historically outperformed other investment types, providing a greater return potential.

- Consider tax-advantaged accounts like IRAs or 401(k)s that can yield higher returns while minimizing taxable income.

Importance of Reinvesting Dividends and Interest Payments

Reinvesting dividends and interest payments magnifies the power of compound interest. When you reinvest earnings, they become part of your principal, and future interest calculations will include this increased amount. This practice can significantly enhance your investment growth over time.

“Reinvesting dividends can boost total returns by as much as 20% over several decades.”

For example, if you own a stock that pays a $5 dividend and you choose to reinvest it, you’re not only maintaining your investment’s value, but you’re also increasing the number of shares you own. In the long run, this can contribute substantially to your overall wealth accumulation.

Checklist for Optimizing Investment Accounts

Optimizing your investment accounts for compound interest involves several key actions that can enhance your overall investment experience. The following checklist can serve as a guide:

- Set up automatic contributions to ensure regular investment, which can help take advantage of dollar-cost averaging.

- Review and adjust your investment portfolio periodically to ensure it aligns with your risk tolerance and financial goals.

- Minimize fees and expenses associated with investment accounts, as high fees can eat into returns significantly.

- Utilize tax-loss harvesting strategies to offset gains and keep your investment growth healthy.

- Stay informed about market trends and adjust your strategies accordingly, taking advantage of opportunities as they arise.

Future Trends in Investments and Compound Interest

Source: paradigmlife.net

The landscape of investments and how individuals harness the power of compound interest is constantly evolving. As we look ahead, several emerging trends signal significant shifts in investment strategies and the application of compound interest. Understanding these trends can offer valuable insights for future investors aiming to build wealth effectively.Technology is rapidly transforming personal finance, making compound interest strategies more accessible and dynamic than ever before.

This shift is not only altering traditional investment avenues but also enhancing how individuals can leverage compound interest through innovative platforms and tools.

Emerging Investment Trends Impacting Compound Interest

Several investment trends are on the rise that may influence the application of compound interest in the coming years:

1. Cryptocurrencies and Decentralized Finance (DeFi)

The rise of cryptocurrencies and DeFi platforms has introduced new ways to earn interest on investments. Many platforms offer high-interest rates on crypto deposits, allowing users to experience compound interest in a more volatile yet potentially high-reward environment.

2. Robo-Advisors

Automated investment platforms are increasingly popular, providing users with tailored investment strategies that utilize compound interest. These services often leverage algorithms to optimize investment portfolios, ensuring that users benefit from compounding over time without needing extensive financial knowledge.

3. Sustainable Investing

As more investors seek ethical and sustainable options, the demand for green investments is growing. Sustainable funds can still utilize the principles of compound interest, potentially leading to significant returns as these sectors expand and mature.

4. Fractional Investing

The ability to invest in fractions of high-value assets, such as real estate and stocks, has opened up new opportunities for investors. This trend allows individuals to benefit from compound interest on smaller investments, democratizing access to wealth-building assets.

5. Impact of Artificial Intelligence and Machine Learning

AI technologies are optimizing investment strategies and personal finance management. These innovations can analyze vast amounts of data, improving predictions for investment growth and compounding effects.

Influence of Technology on Personal Finance

Technology’s role in personal finance cannot be overstated. With the advent of budgeting apps, investment tracking tools, and financial education platforms, managing and maximizing compound interest has become more streamlined. For instance, budgeting apps enable users to allocate funds toward investment accounts more effectively, ensuring they consistently contribute to their financial growth. Investment tracking tools allow for clearer visibility of compound growth, helping savers understand the long-term impact of their contributions.

Additionally, educational platforms offer resources and insights on maximizing compound interest through various investment vehicles. This democratization of financial literacy empowers more individuals to make informed decisions that enhance their wealth accumulation strategies.

Predictions on the Evolution of Compound Interest Principles

Looking ahead, it is anticipated that compound interest principles will continue to evolve as financial landscapes change. In the next few decades, we may see the following developments:

Integration with Social Media

Investing could become more integrated with social platforms, where peer influence and community support drive investment decisions. This could lead to a more collective approach to wealth-building strategies.

Increased Focus on Educational Resources

As technology advances, there will likely be a greater emphasis on financial education, making it easier for individuals to grasp complex concepts like compound interest and apply them effectively to their investments.

Global Investment Opportunities

As markets become more interconnected, investors may have access to a wider array of global investment options that utilize compound interest. This may include international real estate, emerging market stocks, and global mutual funds.

Sustainability and Ethical Investment Growth

The future of investments will likely lean more toward sustainability, pushing more funds into green technologies and ethical companies. This shift can amplify the compounding effects as these sectors grow, potentially leading to substantial long-term financial rewards.Overall, the landscape of investments and the application of compound interest are poised for exciting transformations. Staying informed about these trends will be crucial for those looking to build wealth effectively in the years to come.

Closing Summary

Source: kajabi-cdn.com

In conclusion, the journey of How Compound Interest Can Make You a Millionaire is rooted in patience, smart decisions, and consistency. By utilizing the principles we’ve discussed, you have the power to grow your wealth exponentially over time. Remember, every dollar invested today can pave the way for a prosperous future, so start your journey to financial freedom today.

Expert Answers

What is the difference between compound interest and simple interest?

Compound interest is calculated on the initial principal and also on the accumulated interest from previous periods, while simple interest is calculated only on the principal amount.

How often should I reinvest my earnings for compound interest?

The more frequently you reinvest your earnings (e.g., monthly or quarterly), the more you’ll benefit from compound interest, as your investment grows at a faster rate.

Can compound interest work for any investment?

Yes, compound interest can be applied to various investment vehicles, such as savings accounts, stocks, bonds, and mutual funds, as long as the interest earned is reinvested.

Is it too late to start investing and benefit from compound interest?

It’s never too late to start investing; even if you begin later in life, you can still benefit from compound interest, although starting earlier provides greater advantages.

How does inflation affect compound interest?

Inflation can erode the purchasing power of your returns, so it’s important to choose investments that can generate returns higher than the inflation rate to truly benefit from compound interest.

![Ufit:index [MLZ - Wiki]](https://money.narasi.tv/wp-content/uploads/2025/06/faa25d526aee0c35e409a2fb33531950-350x250.jpg)