How to Save Money with a Budgeting App That Works takes center stage as we delve into the world of personal finance management. Budgeting apps have revolutionized how we track our expenses and income, providing a streamlined approach that can help anyone gain control over their finances. With features designed to simplify financial tracking, these digital tools not only highlight spending habits but also guide users towards smarter financial decisions.

In today’s fast-paced environment, the significance of utilizing budgeting apps cannot be overstated. They not only assist in keeping your finances organized but also come packed with features that can help users set and achieve their savings goals. As we explore the ins and outs of budgeting apps, we’ll uncover their advantages, essential features, and effective strategies for maximizing savings.

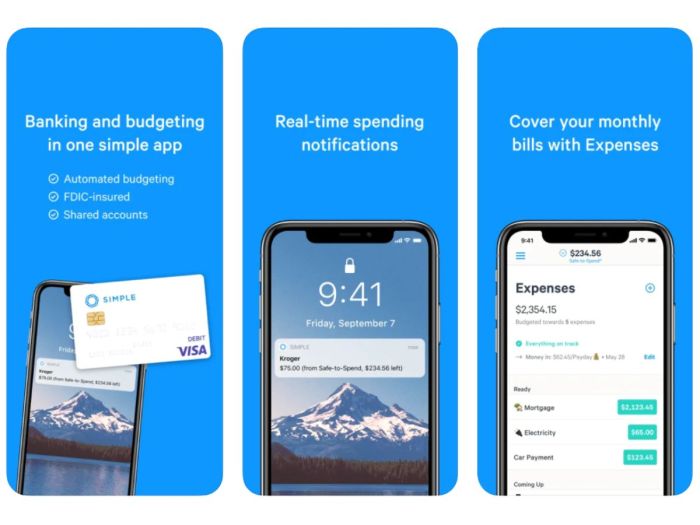

Importance of Budgeting Apps

Source: co.uk

In today’s fast-paced world, managing personal finances can feel overwhelming. Budgeting apps have emerged as indispensable tools that simplify this process, making it easier for individuals to gain control over their financial lives. With the right app, tracking expenses and income becomes a straightforward task, empowering users to make informed decisions and achieve their financial goals.The significance of using budgeting apps lies in their ability to provide real-time insights into spending habits.

By digitally tracking expenses, users can identify patterns, distinguish between needs and wants, and adjust their financial behaviors accordingly. This level of awareness can lead to healthier financial habits, reduced debt, and increased savings. Furthermore, budgeting apps often come equipped with features such as notifications for due dates, spending alerts, and goal-setting capabilities, which enhance the overall user experience and encourage better financial habits.

Benefits of Tracking Expenses and Income

Utilizing budgeting apps to track expenses and income offers numerous advantages that traditional budgeting methods may lack. A few of these benefits include:

- Enhanced accuracy: Digital tools minimize the risk of manual errors that can occur with paper-and-pencil budgeting.

- Real-time updates: Users receive immediate feedback on their spending, allowing for timely adjustments to avoid overspending.

- Visual representations: Many apps provide charts and graphs that illustrate spending habits, making it easier to analyze financial trends over time.

- Convenience: With budgeting apps available on smartphones, users can manage their finances anytime, anywhere, which makes it more likely that they will stick to their budgets.

- Goal-oriented features: Many apps allow users to set savings goals and milestones, helping them stay motivated and focused on achieving their financial objectives.

Challenges Faced Without a Budgeting App

Many individuals encounter difficulties in managing their finances when they rely solely on traditional methods. Some of the common challenges include:

- Inconsistent tracking: Without a digital tool, it can be easy to forget or overlook expenses, leading to inaccurate budget assessments.

- Difficulty in analysis: Manual tracking makes it challenging to identify spending trends and patterns, potentially resulting in poor financial decisions.

- Time-consuming processes: Keeping track of finances on paper can be tedious and time-consuming, which might discourage individuals from maintaining a budget.

- Lack of motivation: Traditional budgeting methods may not have the engaging features found in apps, making it harder to stay committed to financial goals.

- Limited access to information: Without digital tools, users miss out on timely insights, which can hinder their ability to react quickly to financial situations.

Features of an Effective Budgeting App

A budgeting app can be a game-changer when it comes to managing your finances effectively. With the right features, these apps can simplify tracking expenses, planning budgets, and achieving financial goals. Let’s delve into the essential functionalities that make a budgeting app not just useful but truly effective.

Essential Features to Look For in a Budgeting App

When choosing a budgeting app, certain features can significantly enhance your experience and ensure that the app meets your financial management needs. Here are some key elements to consider:

- User-Friendly Interface: A clean, intuitive design allows users to navigate the app easily, making it more likely that they will consistently use it.

- Expense Tracking: The ability to categorize and track expenses in real-time helps users understand their spending habits better.

- Budget Planning: Effective budgeting apps provide tools to create and modify budgets based on income and spending patterns.

- Financial Goal Setting: Users should be able to set, track, and manage financial goals, such as saving for a vacation or paying off debt.

- Reporting and Insights: Robust reporting features that offer insights into spending habits can help users make informed financial decisions.

User-Friendly Interfaces Versus Complex Designs

The design of a budgeting app plays a crucial role in user engagement and effectiveness. User-friendly interfaces prioritize simplicity and clarity, allowing users to find what they need without confusion. In contrast, complex designs may overwhelm users with unnecessary features or a cluttered layout. For example, an app like Mint employs a straightforward interface that displays key financial information at a glance, facilitating easy navigation.

On the other hand, apps with convoluted designs may result in users abandoning the app altogether due to frustration.

Examples of Budgeting Apps with Unique Functionalities

Several budgeting apps stand out due to their innovative functionalities that cater to diverse financial management needs. Below are some noteworthy examples:

- YNAB (You Need A Budget): This app emphasizes proactive budgeting, encouraging users to allocate every dollar they earn towards specific financial goals.

- EveryDollar: This app utilizes a zero-based budgeting approach, where users plan their expenses down to the last cent, making it easier to prioritize spending.

- GoodBudget: With a digital envelope system, this app allows users to visualize their spending limits and stay within their budget more effectively.

Incorporating these features into your budgeting app will enhance your financial management experience, leading to better savings and smarter spending habits.

Steps to Set Up a Budgeting App

Source: manofmany.com

Setting up a budgeting app can be an empowering step towards better financial management. With the right tools, you can gain a clearer picture of your financial situation and take control of your spending habits. In this section, we’ll walk you through the necessary steps to effectively set up a budgeting app, ensuring you input your income and expenses accurately for optimal tracking.

Step-by-Step Guide to Setting Up a Budgeting App

To begin with, it’s essential to choose a budgeting app that aligns with your financial goals and preferences. Once you’ve made your selection, follow these steps to get started:

1. Download and Install the App

Visit your device’s app store, search for your chosen budgeting app, and install it. Open the app to commence the setup process.

2. Create an Account

Most apps will require you to create an account. Enter your email address, choose a secure password, and verify your account via your email if prompted.

3. Provide Your Financial Information

Input your primary financial details, including your income sources, bank accounts, and any outstanding debts. This information will help the app construct a personalized budget for you.

4. Set Your Budget Goals

Determine what you want to achieve with your budgeting efforts. Whether it’s saving for a trip, paying off debt, or building an emergency fund, input these goals into the app.

5. Connect Your Financial Accounts

For more accurate tracking, connect your bank accounts and credit cards to the app. This allows the app to automatically import transactions, making it easier to keep your budget up to date.

Inputting Income and Expenses Accurately

Accurate input of income and expenses is crucial in creating a reliable budget. Here’s how to do it effectively:

Record All Sources of Income

Include your salary, freelance work, side gigs, and any passive income streams. Ensure that you input the net income (after taxes) for precise calculations.

Track All Expenses

Document every expenditure, including fixed costs (like rent and utilities) and variable costs (like groceries and entertainment). Being thorough at this stage sets the foundation for better insights into your spending habits.For example, if your monthly income is $3,000, record it as a total without estimates. Similarly, if you spend $200 on groceries and $100 on entertainment, list each separately to see how they contribute to your overall budget.

Categorizing Expenses for Better Tracking

Organizing your expenses into categories will enhance your ability to analyze spending patterns. Here’s a suggested way to categorize your expenses:

Fixed Expenses

Regular payments that don’t change month to month (e.g., rent, insurance).

Variable Expenses

Fluctuating costs that can vary month to month (e.g., groceries, dining out).

Discretionary Spending

Non-essential expenses that can be modified or eliminated (e.g., entertainment, hobbies).

Savings and Investments

Funds allocated for savings accounts, retirement, and other investment accounts.By categorizing expenses, you can more easily identify areas where you can cut back. This approach not only aids in budgeting but can also highlight spending trends over time.

“By tracking every penny and categorizing your spending, you empower yourself to make informed financial decisions.”

This organized method allows you to visualize your financial habits and adjust accordingly, leading to improved financial wellness in the long run.

Strategies for Saving Money Using a Budgeting App

Setting up a budgeting app is just the beginning of your journey toward financial wellness. The real power lies in how you leverage the features and functionalities of the app to enhance your saving strategies. By implementing these strategies, you can make the most out of your budgeting app and see tangible results in your savings.

Setting Savings Goals within the App

Establishing clear savings goals within your budgeting app is crucial for tracking your progress and staying motivated. Most budgeting apps allow you to create specific savings goals, whether for an emergency fund, vacation, or a new gadget. To effectively set and achieve these goals, consider the following steps:

- Define your goals clearly, specifying exactly how much you want to save and by when.

- Break larger goals into smaller, manageable milestones to avoid feeling overwhelmed.

- Use the app’s features to categorize your goals, making it easier to prioritize your savings efforts.

- Regularly monitor your progress through the app and adjust your contributions based on your budget and spending changes.

By tracking your goals consistently, you can maintain focus and increase your chances of achieving them.

Adjusting Spending Habits to Maximize Savings

Changing your spending habits can significantly impact your ability to save money. Utilizing a budgeting app can provide immediate insights into your spending patterns, helping you identify areas for adjustment. For instance, if you discover that a substantial portion of your monthly budget goes towards dining out, you can make conscious decisions to cut back.Consider these practical strategies to adjust your spending habits:

- Identify non-essential expenses that can be reduced or eliminated. For example, consider meal prepping to save on dining costs.

- Set daily or weekly limits for discretionary spending categories, like entertainment or shopping. The app can alert you when you approach these limits.

- Leverage the app’s reporting features to visualize your spending habits over time, allowing you to make data-driven decisions about necessary adjustments.

- Make it a habit to review your budget regularly and compare actual spending against your budgeted amounts to identify unexpected expenses.

As you adjust your habits, even small changes can add up over time, significantly impacting your savings.

Real-Life Scenarios Demonstrating Impact

To better illustrate the potential savings from adjusting your spending habits through a budgeting app, consider these scenarios:Scenario 1: A user discovers they spend $300 monthly on coffee. By reducing their coffee shop visits by half and brewing at home, they save $150 monthly. Over a year, this small change results in $1,800 saved.Scenario 2: Another user realizes their subscription services cost $120 a month.

After reviewing and canceling unused subscriptions, they cut their costs to $60. This results in an extra $720 in savings annually.These examples show how practical adjustments can lead to substantial savings when tracked within a budgeting app. The insights gained from monitoring these changes can motivate further improvements, enhancing your overall financial health.

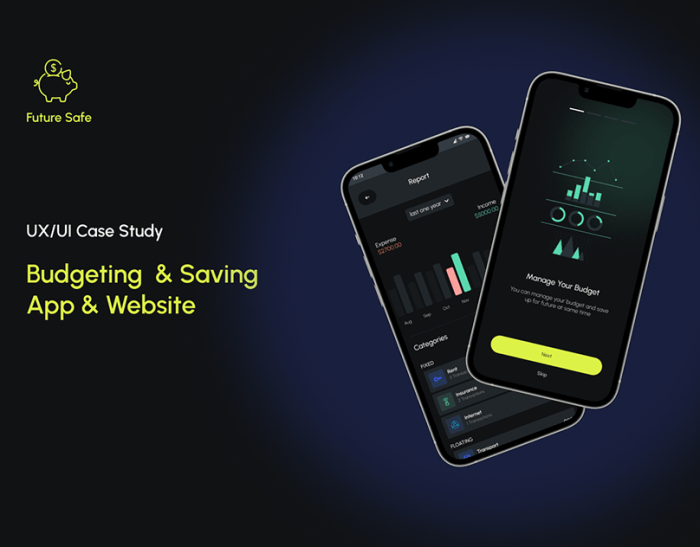

Common Mistakes to Avoid with Budgeting Apps

Source: behance.net

Budgeting apps can be a powerful tool for managing finances, but many users fall into common traps that undermine their effectiveness. Understanding these pitfalls will help you navigate the budgeting landscape more efficiently and make the most out of your app. By recognizing these mistakes, you’ll be better prepared to maintain control over your financial journey.

Overlooking Regular Updates

One frequent mistake is neglecting to update entries in the app. Users often forget to log expenses or income, leading to inaccurate financial snapshots. To overcome this, establish a daily or weekly routine for checking and updating your budget. This consistency helps you remain aware of your spending habits and ensures that your budget reflects your current financial situation.

Setting Unrealistic Goals

Many individuals set overly ambitious savings goals, which can lead to frustration and a sense of failure. Instead, focus on creating achievable, incremental goals that motivate you to save without feeling overwhelming. Break down larger goals into smaller, manageable steps, and celebrate each milestone. This approach makes the saving process more rewarding and sustainable.

Ignoring Categories and Spending Limits

Another common oversight is not assigning specific categories or limits to expenses. Without clear boundaries, it’s easy to overspend in certain areas. Take the time to categorize your expenses—such as groceries, entertainment, and transportation—and set realistic limits for each category. This practice will enable you to monitor where your money goes and make adjustments as needed.

Failing to Utilize App Features

Many budgeting apps come equipped with features designed to enhance your financial management, such as alerts for overspending or insights on spending habits. However, users often fail to leverage these tools. Familiarize yourself with all the functionalities your app offers, such as automatic categorization and detailed reports. Utilizing these features can provide deeper insights into your finances and help you make informed decisions.

Neglecting to Review Financial Goals Regularly

Budgeting isn’t a one-time task; it’s an ongoing process. Many users make the mistake of setting goals and then forgetting to review them. Regularly assess your financial goals and make necessary adjustments based on life changes, unexpected expenses, or shifts in income. This habit will keep your budget dynamic and aligned with your current situation.

Becoming Discouraged by Setbacks

Experiencing setbacks can be discouraging for anyone using a budgeting app. It’s common to encounter unexpected expenses or slip-ups in spending. Instead of viewing these as failures, consider them opportunities to learn and adapt your budget strategy. Acknowledge the setback, analyze what went wrong, and adjust your budget accordingly. This reflective approach will help you stay resilient and committed to your financial goals.

Inconsistent Usage of the App

Inconsistency in using the budgeting app can lead to a disconnect from your financial situation. Regular interaction with the app helps reinforce financial awareness and accountability. Make a habit of checking in daily or weekly, ensuring you are engaged with your budgeting process. This practice keeps your financial goals top of mind and helps prevent overspending.

Staying Motivated and Consistent

To maintain motivation and consistency, it’s crucial to create a support system. Share your financial goals with a friend or family member who can help keep you accountable. Additionally, visualize your goals by creating a vision board or tracking your progress in a tangible way. For instance, if you’re saving for a vacation, keep a chart that illustrates your savings milestones.

This visual representation can serve as a constant reminder of your aspirations and keep you motivated on your journey to financial health.

Integrating a Budgeting App with Other Financial Tools

Integrating a budgeting app with other financial tools can significantly enhance your financial management experience. By linking your budgeting app to your bank accounts, investment platforms, and other financial services, you can gain a holistic view of your finances, making it easier to track spending, savings, and investment goals. This seamless integration allows for real-time updates and better financial decision-making.Connecting your budgeting app with your bank accounts and investment platforms offers several advantages.

First, automatic syncing ensures that your transactions are accurately captured, reducing the need for manual entry and minimizing the risk of errors. This connectivity allows you to monitor your spending patterns against your budget in real-time, making it easier to identify areas for improvement. Additionally, integrated investment tools can provide insights into how your spending impacts your overall financial goals, helping you make informed choices about saving and investing.

Compatible Financial Tools Enhancing Budgeting Efforts

Numerous financial tools can be integrated with budgeting apps to optimize your financial planning. Here are some notable examples:

- Bank Accounts: Most budgeting apps allow you to link directly to your bank accounts, enabling automatic transaction import and categorization. This helps in real-time tracking of your spending habits.

- Investment Platforms: Apps like Acorns or Robinhood can be linked to budgeting apps to monitor your investments alongside your budget, providing a comprehensive view of your financial health.

- Expense Trackers: Some budgeting apps integrate with expense tracking tools, allowing for detailed insights into spending patterns beyond what traditional bank statements show.

- Bill Payment Services: Linking bill payment systems helps automate reminders and payments, ensuring you never miss a due date while keeping your budget aligned.

- Financial Planning Software: Tools like Mint or YNAB (You Need A Budget) can sync with various financial accounts, helping create a unified financial strategy.

Data security is paramount when linking budgeting apps to financial accounts. Users should prioritize apps that utilize encryption and other security protocols to protect sensitive information. Ensuring that the budgeting app has robust security measures in place, such as two-factor authentication, can minimize the risk of unauthorized access. Always review privacy policies and user feedback regarding security features before integrating financial tools to safeguard your personal data.

Integrating budgeting apps with financial services enhances tracking efficiency, promotes better spending habits, and supports informed financial decision-making.

Tracking Progress and Making Adjustments

Regularly monitoring your budget through a budgeting app is crucial for maintaining financial health and achieving your savings goals. It’s not just about setting a budget and forgetting it; consistent review of your spending habits allows you to identify areas where you may be overspending and make necessary adjustments. This ongoing process ensures that your budgeting efforts remain effective, keeping you on track toward your financial aspirations.To effectively track your budget performance, utilize the analytics and reporting features available in your budgeting app.

These tools provide insights into your spending patterns, income fluctuations, and overall financial health. By reviewing your budget on a weekly or monthly basis, you can see how well you’re adhering to your set limits and if any changes are needed.

Methods for Adjusting Budgets

Flexibility in your budgeting approach is essential, especially as life circumstances change. Adjusting your budget based on financial shifts or unexpected expenses can help you stay aligned with your financial goals. Here’s how you can adapt your budget effectively:

- Set Periodic Review Dates: Schedule monthly reviews to assess your budget performance and make adjustments. This routine check-in helps you address any discrepancies promptly.

- Identify Fixed vs. Variable Expenses: Recognize which expenses are essential and which can fluctuate. For instance, fixed costs like rent should remain stable, while variable costs like groceries may need adjustment based on consumption patterns.

- Factor in Life Changes: Adjust your budget if significant events occur, such as a job change, a new family member, or unexpected medical expenses. These changes may require a realignment of your financial priorities.

- Utilize App Alerts: Many budgeting apps offer notification features that alert you when you’re nearing budget limits. Use these alerts to make timely adjustments before overspending occurs.

Utilizing app analytics can significantly enhance your financial decision-making. Most budgeting apps provide detailed reports and visualizations that show where your money is going. By analyzing this data, you can pinpoint areas for improvement and optimize your spending.

“Regularly reviewing your budget helps to identify spending leaks, ensuring you are always in control of your finances.”

For instance, if you notice a consistent overspend in dining out, you can decide to allocate a smaller portion of your budget to that category and compensate by reducing other discretionary expenses. Furthermore, you can set realistic goals based on past spending habits, allowing for a more achievable budget that reflects your lifestyle while promoting savings.In conclusion, the practice of regularly tracking your budget and making required adjustments is vital to navigating your financial journey effectively.

By leveraging the capabilities of your budgeting app, you can create a more responsive and personalized financial strategy that adapts to your life changes and spending habits.

Outcome Summary

In conclusion, mastering the art of saving money with a budgeting app is within everyone’s reach. By understanding the key features of these apps, setting up a budget, and employing effective strategies, users can truly transform their financial habits. Remember, the journey to financial wellness is about consistency and being proactive. With the right budgeting app, you can take charge of your finances, avoid common pitfalls, and celebrate your savings milestones along the way.

Commonly Asked Questions

What are the best budgeting apps available?

Some of the best budgeting apps include Mint, YNAB (You Need a Budget), and PocketGuard, each offering unique features to suit different financial needs.

Can I use budgeting apps for business expenses?

While most budgeting apps are designed for personal finance, some can be adapted for small business expenses; however, dedicated business accounting software might be more suitable.

Are budgeting apps secure for my financial data?

Reputable budgeting apps use encryption and security measures to protect your data, but it’s essential to research the app’s security features before linking it to your financial accounts.

How often should I update my budgeting app?

Regular updates, ideally weekly or after significant expenses, help ensure your budget remains accurate and reflective of your current financial situation.

What if I exceed my budget in a category?

If you exceed your budget in a category, review your spending habits, adjust your budget if necessary, and consider setting limits to prevent overspending in the future.

![Ufit:index [MLZ - Wiki]](https://money.narasi.tv/wp-content/uploads/2025/06/faa25d526aee0c35e409a2fb33531950-120x86.jpg)