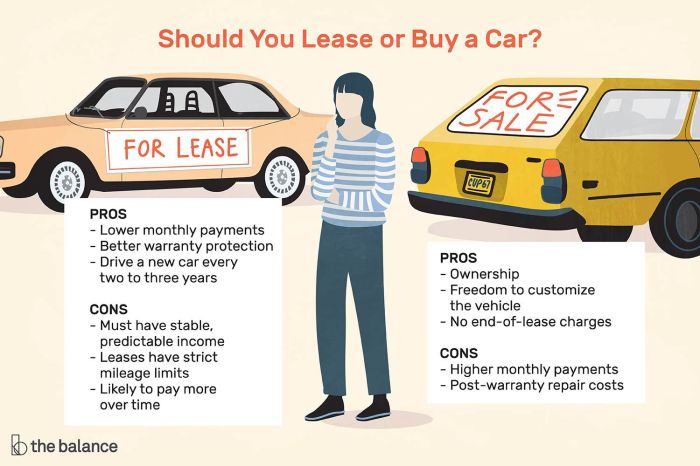

Should You Lease or Buy a Car? Financial Pros and Cons is a question that many drivers ponder, often feeling overwhelmed by the financial implications of each option. Both leasing and buying come with their unique advantages and challenges, making it essential to weigh your choices carefully. Whether you’re looking for short-term flexibility or long-term investment, understanding the nuanced financial landscape will help you make an informed decision.

In this discussion, we’ll explore the financial overview, long-term implications, maintenance responsibilities, and lifestyle considerations associated with leasing versus buying a car. By delving into these aspects, you’ll gain clarity on how each choice aligns with your personal financial situation and driving needs.

Financial Overview of Leasing vs. Buying

Source: thebalance.com

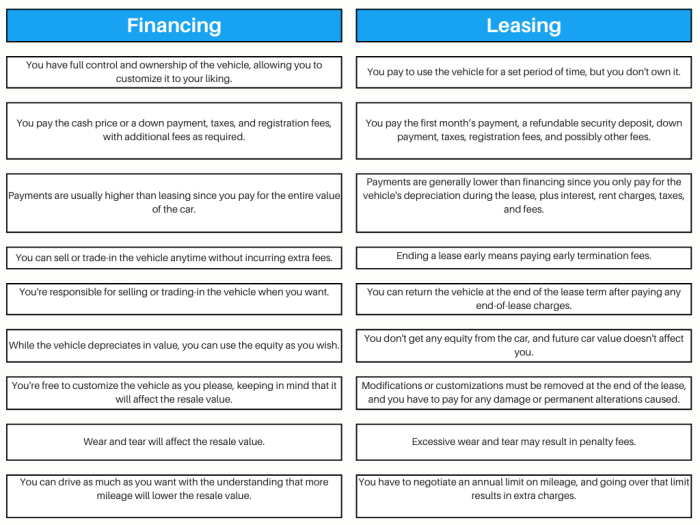

When it comes to acquiring a vehicle, understanding the financial implications of leasing versus buying is essential. Each option presents distinct cost structures that can significantly affect your budget and long-term financial health. A thorough comparison of the initial costs, monthly payments, and potential hidden fees can help you make an informed decision.The initial costs associated with leasing a car tend to be lower than those of buying outright.

Typically, when leasing, you may only need to cover the first month’s payment, a security deposit, and any applicable taxes and fees. In contrast, purchasing a vehicle often requires a substantial down payment, which can be 10% to 20% of the car’s total price.

Monthly Payment Differences

Understanding how monthly payments compare between leasing and buying can aid in creating a solid budgeting strategy. Leasing generally provides lower monthly payments since you are only financing the vehicle’s depreciation rather than the entire purchase price. Below is a simple comparison of estimated monthly payments for both options:

- Leasing Example: A car with a retail value of $30,000, leased over three years, might yield monthly payments of around $300.

- Buying Example: The same vehicle purchased with a 20% down payment would lead to monthly payments of approximately $450 over a five-year loan term, assuming a typical interest rate.

The significant difference in monthly payments can heavily influence an individual’s financial planning. Lower payments from leasing can free up cash for other expenses, but it’s crucial to consider the long-term financial picture.

Hidden Costs in Leasing and Buying

Both options come with potential hidden costs that can affect the overall financial picture. Recognizing these costs is important for making a well-rounded decision. Below are key hidden expenses associated with leasing and buying:

- Leasing:

- Excess Mileage Fees: Leasing contracts typically limit annual mileage, often around 12,000 miles per year. Exceeding this limit can incur hefty charges—usually around 15 cents per mile.

- Wear and Tear: Charges may apply for damage beyond normal wear, potentially adding unexpected costs at the end of the lease.

- Buying:

- Depreciation: A new car loses about 20% of its value within the first year, impacting resale value significantly.

- Maintenance and Repairs: Owners must take on all maintenance costs once the warranty expires, which can add up over time.

The financial picture can shift considerably when these hidden costs are considered. Awareness of these additional expenses is key to making a decision that aligns with your financial goals and lifestyle.

Long-term Financial Implications

When considering whether to lease or buy a car, understanding the long-term financial implications is crucial. The decision you make will not only affect your immediate budget but also your financial situation in the years to come. Owning a vehicle typically presents several financial advantages that can accumulate over time, making it an essential factor to weigh against leasing.

Financial Benefits of Ownership

Owning a car comes with distinct financial perks that often outweigh the temporary benefits of leasing. Once the car is paid off, the owner enjoys several years without monthly payments, which significantly reduces overall transportation costs. Here are some key points regarding the financial benefits of ownership:

- No Monthly Payments: After the auto loan is settled, owners can allocate their funds toward savings or investments rather than recurring car payments.

- Unlimited Mileage: Owners are free to drive as much as they want without incurring additional fees, a common restriction in leases.

- Customization: Owners have the freedom to modify their vehicles, enhancing personal satisfaction and potentially increasing resale value.

Depreciation Rates of Leased vs. Owned Vehicles

Understanding depreciation is vital when comparing leased and owned vehicles. Typically, cars depreciate rapidly in their first few years, with most losing around 20% to 30% of their value within the first year of ownership. However, the financial implications differ significantly between leasing and buying:

- Leased Vehicles: Lessees pay for the vehicle’s depreciation during the lease term, which means they never build equity. At the end of the lease, they return the car without any ownership.

- Owned Vehicles: Owners face depreciation as well, but they retain the vehicle’s residual value. A well-maintained car can still offer a substantial resale value after several years, offsetting initial costs.

Potential Resale Value

One of the most significant advantages of buying a vehicle is the potential for resale value. While leased vehicles have no equity, a purchased car can be sold or traded in, providing a financial return on the initial investment. Here’s how this plays out in practice:

- Resale Return: Depending on the model and condition, some vehicles can retain up to 50% of their original value after five years. For instance, a car originally purchased for $30,000 might sell for $15,000 or more.

- Equity Building: With ownership, every payment contributes to your equity in the vehicle. When it’s time to sell, this equity can be used as a down payment on your next vehicle.

“Buying a car allows you to build equity over time, providing not just transportation, but a potential asset that can be leveraged for future financial needs.”

Maintenance and Repair Responsibilities

When considering whether to lease or buy a car, understanding the maintenance and repair obligations associated with each option is crucial. These responsibilities can significantly impact your overall cost of ownership and the convenience of your driving experience. The differences in responsibilities can affect your decision-making process, especially when it comes to budgeting for your vehicle’s upkeep.

Leased cars typically come with specific maintenance obligations that differ from those of owned vehicles. When you lease a vehicle, you are often required to adhere to the manufacturer’s prescribed maintenance schedule, which includes regular oil changes, tire rotations, and other necessary services. This requirement ensures that the vehicle remains in good working condition and retains its value. In contrast, if you own the car, you have the freedom to choose when and how often to perform maintenance, which can lead to potential savings or additional costs based on your individual choices.

Warranty Coverage Differences

The warranty coverage for leased vehicles generally differs from that of owned cars, impacting maintenance responsibilities. In many cases, leased vehicles are covered by a manufacturer’s warranty for the duration of the lease. This means that major repairs, such as engine or transmission issues, may be covered at no cost to the lessee. Conversely, once you own a vehicle, warranty coverage is typically limited to a specific timeframe or mileage, after which you bear the full responsibility for repair costs.

For those considering the financial implications of maintenance and repairs, it’s important to recognize the differences in warranty coverage:

- Leased vehicles usually include comprehensive coverage for major repairs throughout the lease term.

- Owned vehicles may require extended warranties for additional coverage, which can add to overall expenses.

- Regular maintenance on leased cars must adhere to specified schedules to maintain warranty validity.

Cost Implications of Repairs

The cost of repairs significantly varies between leasing and buying scenarios, influencing overall financial outcomes. For leased vehicles, minor repairs and maintenance are typically the lessee’s responsibility, but major aspects like warranty-covered repairs can alleviate financial burdens. On the other hand, with an owned car, the owner must cover all repair costs once the warranty period has expired. This can lead to unexpected expenses, particularly as the vehicle ages.

When evaluating these cost implications, consider the following key points:

- Leased vehicles often incur lower repair costs due to warranty coverage, reducing the financial pressure on the lessee.

- In contrast, owners may face higher repair bills as their vehicle ages, especially if it surpasses the warranty mileage limit.

- Budgeting for potential repairs in owned vehicles can lead to financial strain if significant issues arise unexpectedly.

In summary, whether you choose to lease or buy, understanding the maintenance and repair responsibilities associated with each option is essential. This knowledge helps you make informed decisions about your vehicle investment and prepare for both routine upkeep and unexpected costs.

Flexibility and Lifestyle Considerations

Source: approvalgenie.ca

Leasing a car often provides a level of flexibility that can be particularly appealing for individuals who enjoy frequently changing their vehicles. This aspect is especially significant for those who prefer staying current with automotive trends and technologies or who face changing lifestyle needs. The choice between leasing and buying can directly impact your day-to-day life, financial obligations, and long-term planning.Leasing allows drivers to switch vehicles every few years, typically at the end of a lease term, without the hassle of selling or trading in a vehicle.

This flexibility is beneficial for those who may need a different type of vehicle due to changes in family size, job requirements, or personal interests. For example, a young professional might opt for a sporty coupe now and later shift to a family-friendly SUV without facing the depreciation losses associated with ownership.

Adaptation to Vehicle Ownership vs. Leasing

Adapting to vehicle ownership entails a different mindset compared to leasing. Owners must consider long-term maintenance and the eventual decline in a vehicle’s value, while lessees can enjoy a more temporary relationship with their vehicle. This section Artikels the lifestyle adjustments that come with either option:

- Ownership Commitment: Owning a car requires a commitment to long-term upkeep and investment, including repairs, insurance, and other expenses that can add up over time.

- Leasing Simplicity: Leasing typically includes warranty coverage and fewer repair responsibilities, which can lead to lower stress and fewer financial surprises.

- Financial Planning: Owners need to factor in depreciation and resale value, while lessees mostly focus on monthly payments and potential fees at the end of the lease term.

- Changing Needs: Leasing supports lifestyle changes more readily. For instance, a person may need a compact car for city commuting but later require a larger vehicle for family trips.

Mileage Restrictions in Leasing Agreements

Mileage limits are an essential consideration when it comes to leasing versus buying. Leasing agreements typically impose annual mileage restrictions, often ranging from 10,000 to 15,000 miles per year. Exceeding these limits can result in significant financial penalties, making it crucial for prospective lessees to accurately assess their driving habits.In contrast, owning a car does not impose such restrictions. This flexibility can be especially beneficial for those who frequently travel long distances or have unpredictable commutes.

Not adhering to mileage limitations can lead to costly fees that outweigh the benefits of lower monthly payments.

“Understanding the implications of mileage restrictions is vital for anyone considering leasing, as exceeding limits can turn a seemingly great deal into a financial burden.”

In summary, while leasing offers the allure of regular vehicle changes and reduced maintenance stress, it comes with specific lifestyle adaptations and potential mileage constraints that can influence overall costs and suitability for different individuals. Taking the time to evaluate these factors can help in making a choice that best aligns with one’s lifestyle and financial goals.

Tax Implications

When deciding between leasing or buying a vehicle, understanding the tax implications can significantly influence your financial decision. Tax benefits can vary depending on whether the vehicle is used for personal or business purposes. Both leasing and buying come with different sets of deductions that can affect your overall tax liability, and it’s essential to know how these options align with your financial situation.Leasing a vehicle can provide a unique advantage for business owners, particularly those who frequently travel or require a vehicle for work purposes.

One of the main tax benefits associated with leasing is the ability to deduct lease payments as a business expense. This deduction can be particularly useful, as it reduces taxable income. On the other hand, vehicle ownership may allow for different deductions, such as depreciation and interest on car loans. However, the extent of these deductions can vary based on personal use versus business use.

Tax Benefits of Leasing for Business Purposes

Leasing a vehicle for business can result in several tax benefits that can enhance cash flow and reduce taxable income. Here are some key points to consider:

- The Internal Revenue Service (IRS) allows business owners to deduct a portion of their lease payments based on the percentage of business use. This can lead to significant savings over time.

- Leasing often requires a lower upfront payment compared to buying, allowing businesses to allocate funds elsewhere while still acquiring necessary transportation.

- Leased vehicles may not depreciate in the same way owned vehicles do, which means businesses may not have to worry about the complexities of depreciation schedules.

- In some cases, if the vehicle is considered a luxury car, there are limits on the amount that can be deducted. However, the IRS provides guidelines to help navigate these limits.

Understanding the distinctions between leasing and ownership can aid in maximizing tax deductions. For individuals, the tax deductions differ significantly.

Personal Tax Deductions for Ownership vs. Leasing

The tax treatment of personal vehicles varies considerably based on whether a vehicle is leased or owned. Here are the primary differences:

- For owned vehicles, personal use does not usually yield a tax deduction, whereas if the vehicle is used for business, the owner may deduct mileage or actual expenses.

- Leased vehicles allow for deductions on lease payments, providing a more immediate tax benefit compared to the slower benefits of depreciation associated with ownership.

- Business owners using a vehicle for both personal and business purposes may need to maintain detailed records to accurately segregate expenses and ensure compliance.

Navigating through state-specific tax considerations is also important, as these can vary widely based on local laws.

State-Specific Tax Considerations

When it comes to leasing or buying vehicles, state-specific taxes can influence the overall cost. Here’s an overview of how these taxes may differ:

- Some states charge sales tax on the total cost of the vehicle purchase, while others only apply it to the total lease payments.

- Certain states offer exemptions or reductions in tax for leased vehicles, but this often depends on the vehicle’s use and the lessee’s business structure.

- Local jurisdictions may impose additional taxes or fees on vehicle leases or purchases, potentially impacting the total cost of ownership or leasing.

Tax implications are an essential aspect to consider in the decision-making process for leasing or buying a vehicle. The differences in deductions and benefits can have a substantial impact on overall financial outcomes, making it crucial to evaluate them in the context of individual financial goals and circumstances.

Insurance Costs and Coverage

When deciding whether to lease or buy a car, one significant factor to consider is the impact on your insurance costs and the required coverage. Insurance premiums can vary greatly depending on the ownership status of your vehicle, and understanding these differences can help you make a more informed financial decision. This segment delves into the nuances of insurance costs associated with leased versus owned vehicles.

Insurance Premium Rates for Leased and Owned Cars

Insurance costs are an essential aspect of any car ownership decision. Generally, leased cars often require higher insurance premiums compared to owned cars. This difference primarily arises because leasing companies typically mandate more comprehensive coverage to protect their investment. Here’s a breakdown of the reasons behind these premium variations:

- Leased vehicles must have full coverage, which includes collision and comprehensive insurance, while owned vehicles may allow for liability-only coverage if the owner chooses.

- Leasing companies may specify minimum coverage limits that are higher than state requirements, leading to increased premiums.

- Since leased cars are often newer and have a higher market value, the cost to replace or repair them in the event of an accident can also result in higher premiums.

Required Coverage Differences

The type of coverage required for a leased car compared to an owned vehicle can differ significantly. Leasing agreements typically stipulate specific insurance requirements that must be met to protect both the lessee and the leasing company. Important distinctions include:

- Leased vehicles usually require both comprehensive and collision coverage, which covers damage to your car regardless of fault.

- Liability coverage, which is mandatory in most states, is also required for both leased and owned vehicles, but the limits may be higher for leased cars.

- Gap insurance is commonly recommended for leased vehicles. This insurance covers the difference between what you owe on the lease and the car’s actual cash value in the event of a total loss.

Additional Insurance Considerations When Leasing

Leasing a vehicle comes with unique insurance considerations that can affect your overall costs and coverage needs. Understanding these can help you navigate your options more effectively:

- Leasing contracts may impose restrictions on the types of modifications you can make, which can affect insurance coverage availability.

- It’s essential to review the leasing terms, as failing to maintain the required coverage can lead to penalties or additional fees.

- Since leased vehicles depreciate rapidly, understanding the potential for higher insurance costs can help you budget appropriately.

Decision-Making Process

Source: inclinemagazine.com

When it comes to the choice of leasing or buying a car, making an informed decision requires careful evaluation of personal financial situations and lifestyle needs. This process can feel overwhelming, but breaking it down into manageable steps can simplify the journey. Here, we provide a structured approach to help you weigh the options effectively. Creating a checklist for evaluating your financial capacity and preferences is essential in this decision-making process.

It allows you to assess key factors that influence whether leasing or buying aligns with your circumstances.

Checklist for Evaluating Leasing vs. Buying

The following factors are crucial to consider when deciding between leasing and buying a vehicle:

- Monthly Budget: Determine how much you can comfortably allocate for vehicle expenses.

- Annual Mileage: Estimate your expected annual mileage to understand lease restrictions.

- Longevity Needs: Evaluate how long you intend to keep the vehicle.

- Maintenance Preferences: Consider how much you’re willing to spend on maintenance and repairs.

- Down Payment: Assess how much upfront payment you can provide.

- Financial Stability: Review your overall financial health and credit score.

- Insurance Costs: Include potential insurance premiums in your budgeting.

Understanding these factors can provide clarity on which option might suit your lifestyle and financial situation better.

Comparison of Pros and Cons

To facilitate easy comparison, here’s a table summarizing the pros and cons of leasing versus buying a car:

| Criteria | Leasing | Buying |

|---|---|---|

| Monthly Payments | Generally lower payments | Higher payments but builds equity |

| Ownership | No ownership of the vehicle | Complete ownership once paid off |

| Maintenance and Repairs | Typically covered under warranty | All costs borne by owner |

| Flexibility | Easy to switch vehicles every few years | Long-term commitment |

| Tax Benefits | Possible deductions for business use | Capable of selling vehicle for future income |

This table highlights the key differences and can serve as a quick reference to aid in your decision-making.

Case Studies of Individuals’ Choices

Real-life examples can provide valuable insight into the outcomes of leasing versus buying a car. One individual, Sarah, opted to lease a new sedan due to her need for a reliable vehicle with lower monthly costs. Despite the mileage restrictions, she found that leasing allowed her to enjoy the latest technology and features every few years. After three years, Sarah returned the vehicle and leased a newer model, which continued to fit her lifestyle needs without the stress of maintenance issues.Conversely, John decided to buy a used truck for his landscaping business.

He made a substantial down payment and financed the rest, ultimately benefiting from the equity he built over time. The truck provided durability and utility for his work, and after several years, he was able to sell it for a good price, allowing him to reinvest in another vehicle.These examples illustrate how personal circumstances can significantly influence the decision to lease or buy, highlighting the importance of considering your own situation when making this choice.

Epilogue

In conclusion, deciding whether to lease or buy a car hinges on your financial goals, driving habits, and lifestyle preferences. Each option presents its own set of financial pros and cons, from initial costs and long-term value to insurance implications and tax benefits. By carefully evaluating these factors, you can find the best route that aligns with your budget and future aspirations, ensuring your vehicle choice enhances your driving experience rather than complicates it.

FAQs

What is generally cheaper in the short term, leasing or buying?

Leasing is usually cheaper upfront due to lower down payments and monthly costs compared to buying.

Are there mileage limits when leasing a car?

Yes, most leases come with mileage restrictions, and exceeding them can result in extra charges.

Can I negotiate the terms of a lease like I can with a purchase?

Yes, you can negotiate lease terms, including the price, mileage limits, and other fees.

What happens at the end of a lease?

At the end of a lease, you have the option to return the car, buy it, or lease a new vehicle.

Is leasing a good option for business use?

Yes, leasing can offer tax benefits for business use, making it an appealing option for companies.