Strategic Benefits of Tokenized Treasury Bills

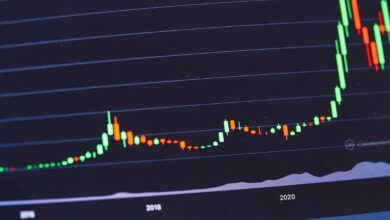

The landscape of corporate treasury management is undergoing a massive shift as blockchain technology intersects with traditional financial instruments. For decades, large corporations have relied on standard banking channels and money market funds to manage their excess cash and maintain liquidity. However, these legacy systems often come with baggage, such as slow settlement times, restricted trading hours, and high intermediation costs.

The emergence of tokenized Treasury bills (T-bills) offers a revolutionary alternative by bringing the world’s safest debt instruments onto the digital ledger. This process allows companies to hold government-backed securities in a digital format that can be moved, traded, or used as collateral with unprecedented speed. By utilizing smart contracts, businesses can automate their liquidity workflows and earn a risk-free rate of return without leaving the decentralized ecosystem.

This transition is not just a technological upgrade but a fundamental change in how a Chief Financial Officer (CFO) views capital efficiency. As more institutional-grade platforms emerge, the adoption of tokenized T-bills is becoming a cornerstone for modern corporate finance strategies. Understanding this mechanism is essential for any organization looking to optimize its balance sheet in the digital age.

Understanding the Concept of Tokenization

Tokenization is the process of converting a physical or traditional financial asset into a digital token on a blockchain. In the case of Treasury bills, the underlying asset is a short-term government debt obligation.

A. Each digital token represents a fractional or full ownership stake in a specific T-bill held in custody.

B. The blockchain acts as a transparent and immutable ledger that tracks ownership in real-time.

C. Smart contracts handle the distribution of interest or “yield” automatically to the token holders.

D. This structure allows for 24/7 trading, unlike traditional bond markets that operate on strict business hours.

E. Legal frameworks ensure that the digital token is a legally binding claim on the physical asset.

By moving T-bills onto the blockchain, we eliminate many of the manual steps required in traditional finance. This leads to a more streamlined and less error-prone management process.

Corporations can now manage their cash reserves with the same ease they use to manage software subscriptions. It is a level of flexibility that was previously unimaginable in the bond market.

The Allure of Risk-Free Yield in DeFi

For a long time, the decentralized finance (DeFi) world was associated with high-risk, volatile assets. Tokenized T-bills have changed this by providing a “risk-free” rate of return within the digital ecosystem.

A. Corporations can earn government-backed interest rates on their stablecoin holdings.

B. This provides a safe haven during periods of high market volatility in other asset classes.

C. The yield is typically higher than what is offered by traditional corporate savings accounts.

D. It allows firms to stay “on-chain,” avoiding the fees and delays of moving money back to legacy banks.

E. Automated yield rebalancing ensures that the corporate treasury is always earning the best possible rate.

Having access to T-bills on-chain means that liquidity doesn’t have to be “lazy” or “idle.” It can be productive while remaining instantly accessible for operational needs.

This is particularly attractive for global companies that operate across multiple time zones. They no longer have to wait for a specific market to open to adjust their cash positions.

Enhancing Capital Efficiency with Atomic Settlement

One of the biggest pain points in traditional finance is the settlement period, often referred to as T+1 or T+2. Tokenized T-bills utilize atomic settlement to move assets and payments simultaneously.

A. Atomic settlement eliminates the time gap between a trade execution and the actual transfer of ownership.

B. This reduces counterparty risk, as the asset and the payment are exchanged in a single, inseparable transaction.

C. It frees up capital that would otherwise be locked in “pending” status for days.

D. Treasury teams can respond to market opportunities or cash shortages in a matter of seconds.

E. The need for expensive reconciliation between different bank ledgers is completely removed.

In a fast-moving economy, time is literally money. Being able to settle a multi-million dollar trade instantly gives a company a massive competitive advantage.

This efficiency ripples through the entire organization. It allows for tighter cash forecasting and more aggressive investment strategies.

Fractional Ownership and Increased Accessibility

Traditional Treasury markets often have high barriers to entry, including large minimum purchase requirements. Tokenization breaks these assets down into smaller, more manageable units.

A. Fractionalization allows companies of all sizes to access the safety of government debt.

B. It enables more precise cash management, allowing firms to invest exact amounts down to the cent.

C. Smaller businesses can benefit from the same institutional-grade security as massive conglomerates.

D. It creates a more liquid secondary market where tokens can be easily sold to other participants.

E. Portfolio diversification becomes easier when you can spread smaller amounts across various maturities.

This democratization of the bond market is a key feature of the blockchain revolution. It levels the playing field for mid-market enterprises.

No longer is the T-bill market a “members-only” club for the world’s largest banks. Every corporate treasurer now has a seat at the table.

Operational Transparency and Real-Time Auditing

Transparency is often a challenge in traditional corporate finance, where assets are hidden behind complex bank statements. Blockchain provides a “single source of truth” for the treasury.

A. Every transaction is recorded on a public or permissioned ledger that is visible to authorized auditors.

B. Real-time tracking of assets reduces the risk of internal fraud or accounting errors.

C. Automated reporting tools can pull data directly from the blockchain for financial statements.

D. Stakeholders and board members can have a clearer view of the company’s liquidity position.

E. The immutable nature of the ledger makes it nearly impossible to tamper with ownership records.

Audits that used to take weeks can now be performed in a fraction of the time. This reduces the administrative burden on the finance department.

A transparent treasury is a more trustworthy treasury. It builds confidence among investors and lending partners.

Tokenized T-Bills as High-Quality Collateral

In the world of finance, collateral is king. Tokenized T-bills are increasingly being recognized as the “gold standard” of collateral in digital lending markets.

A. Firms can use their tokenized T-bills to secure low-interest loans on DeFi platforms.

B. Unlike volatile crypto assets, T-bills provide a stable collateral base that is less likely to face liquidations.

C. This allows companies to access working capital without selling their underlying investments.

D. The process of posting and releasing collateral can be fully automated through smart contracts.

E. It creates a more efficient “repo” (repurchase agreement) market on the blockchain.

This effectively turns a company’s “savings” into a dynamic line of credit. It provides a way to fund operations without diluting equity or taking on high-interest bank debt.

The ability to move collateral instantly between different protocols is a game-changer for risk management. It allows for real-time optimization of the corporate balance sheet.

Navigating the Regulatory Landscape

While the technology is ready, the legal framework for tokenized T-bills is still evolving. Top-tier platforms are working closely with regulators to ensure full compliance.

A. Most tokenized T-bill products are currently restricted to “qualified” or “institutional” investors.

B. Compliance with Know Your Customer (KYC) and Anti-Money Laundering (AML) rules is built into the protocol.

C. Different jurisdictions have varying rules on how digital tokens are classified and taxed.

D. Regulatory “sandboxes” are being used to test these products in a controlled environment.

E. The industry is moving toward standardized legal documents to simplify cross-border adoption.

Compliance is not a hurdle; it is a requirement for institutional trust. The most successful platforms are those that embrace regulation rather than avoid it.

As the laws become clearer, we expect to see a surge in corporate participation. The integration of “legal” and “code” is the final piece of the puzzle.

Security and Custody of Digital Assets

Security is the primary concern for any corporate treasurer. Managing tokenized T-bills requires a robust custody solution that combines the best of technology and physical security.

A. Multi-party computation (MPC) wallets ensure that no single person can move funds unilaterally.

B. Institutional-grade custodians provide “cold storage” options for long-term holdings.

C. Regular security audits of smart contracts are mandatory to prevent vulnerabilities and hacks.

D. Insurance policies specifically designed for digital assets add an extra layer of protection.

E. Whitelisting of approved wallet addresses prevents funds from being sent to unauthorized parties.

A secure custody setup is the foundation of a successful tokenization strategy. It provides the “institutional rails” needed for large-scale capital movement.

Companies must do their due diligence when selecting a technology partner. The strength of the security protocol is just as important as the yield of the asset.

The Integration of Traditional and Decentralized Finance

We are currently in a “hybrid” era where traditional finance (TradFi) and decentralized finance (DeFi) are merging. Tokenized T-bills are the bridge connecting these two worlds.

A. Banks are increasingly launching their own tokenization platforms to serve corporate clients.

B. DeFi protocols are adding “gateways” for institutional users to access government-backed yield.

C. Interoperability protocols allow assets to move between different blockchain networks.

D. Hybrid accounting systems are being developed to track both fiat and digital assets.

E. This convergence is leading to a more robust and resilient global financial system.

The “us vs them” mentality is fading away. The future of finance is a collaborative ecosystem that takes the best parts of both worlds.

Tokenized T-bills are the first major step in this direction. They prove that the blockchain can handle the most serious and conservative financial instruments.

Future Outlook for Corporate Treasury

The adoption of tokenized T-bills is just the beginning. In the future, we expect to see the tokenization of all major corporate treasury assets.

A. Tokenized commercial paper and corporate bonds will provide more ways to manage short-term cash.

B. Real-time, automated tax withholding and payment will be integrated into the token layer.

C. AI-driven treasury bots will manage liquidity across multiple blockchains automatically.

D. We may see the rise of “sovereign digital bonds” issued directly by governments on public ledgers.

E. The concept of a “bank account” may be replaced by a “digital asset vault.”

The role of the corporate treasurer is evolving from a record-keeper to a digital strategist. Those who embrace these tools early will be the ones who lead their companies through the next economic cycle.

The technology is no longer a “nice-to-have” experiment. It is becoming a core requirement for any modern, global business.

Conclusion

Tokenized Treasury bills are fundamentally redefining how corporations handle their liquidity and cash reserves. This technology provides a much-needed bridge between traditional government stability and modern blockchain efficiency. The ability to earn risk-free interest while maintaining instant access to funds is a significant operational advantage. Atomic settlement and fractional ownership are breaking down the barriers that once hindered capital movement. Smart contracts allow for a level of automation in the treasury department that was previously impossible.

Enhanced transparency through the blockchain ensures that ownership records are always accurate and audit-ready. Using these digital tokens as collateral opens up new and more efficient ways to access working capital. The transition toward tokenization is supported by a growing framework of institutional-grade security and regulation. As more major players enter the space, the liquidity and reliability of these platforms will only increase.

Corporate finance is moving away from slow, manual processes toward a future of programmable, real-time money. Investing in the education and infrastructure for digital assets is now a strategic necessity for CFOs. The integration of TradFi and DeFi represents a more resilient future for the global financial ecosystem. The age of tokenized corporate liquidity is here and it is setting a new standard for financial excellence.